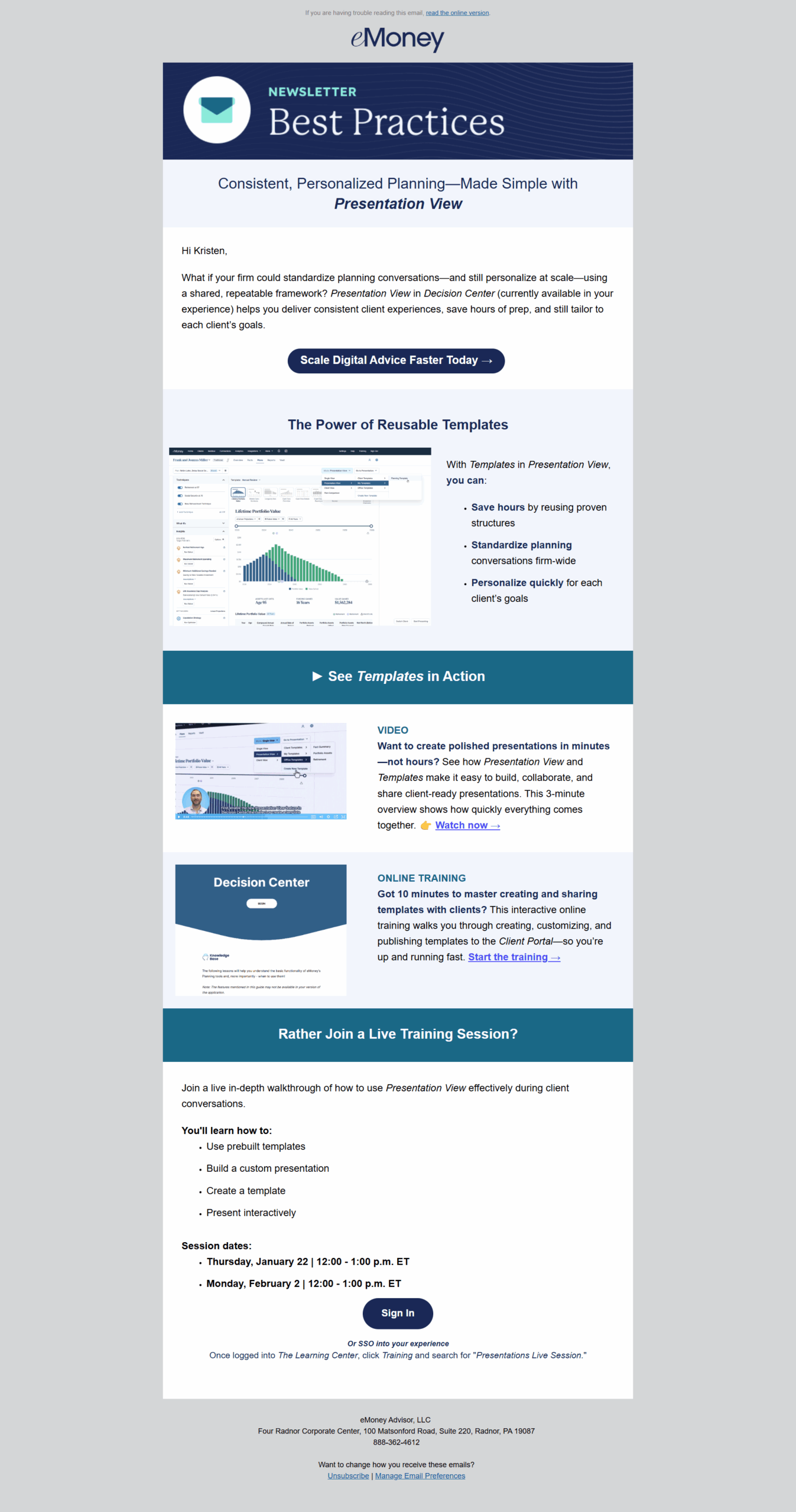

Scale Digital Advice Faster with Presentation View

This email template helps advisors deliver more consistent, personalized guidance at scale—one of the top opportunity areas identified in the eMoney Study: Value of Financial Planning (November 2025). It spotlights Presentation View within Decision Center, featuring a new blog post on how advisors can use the feature to deliver a…