Case Study

Achieving Engagement and Retention Goals Through Collaborative Planning

Waverly Advisors uses eMoney to maximize collaboration with clients.

THE GOAL

Waverly Austin is committed to fostering collaboration, engagement, and planning holistically to build stronger client relationships. They aim to provide an exceptional level of service that not only solves clients’ problems but retains clients for life.

“Our goal is to meet clients where they are, in the way that works for them, to best guide them towards their goals,” says long-time eMoney user James Werner, CFP®, Partner and Wealth Advisor, Waverly Austin.

eMoney advances the goals of this firm by providing an intuitive and engaging planning solution, with a range of options for data visualization that enable effective and actionable communication.

THE SOLUTION

eMoney allows Waverly Austin advisors to collaborate on a broad range of financial topics while monitoring client progress toward goals. Clients can securely share data via the eMoney Vault, while account aggregation features keep key planning information continuously up to date. This information flows seamlessly into Decision Center, where advisors illustrate the impact of important financial decisions. The combination of these tools enables a holistic view of each client’s financial picture.

The flexibility of eMoney allows Waverly Austin to work with clients at different stages of their financial lives, especially as specific planning needs arise. Whether they are saving for future goals or focusing on their financial legacy, advisors can have the conversations that matter most to clients.

“Many of our long-term clients are more interested in the legacy they’ll leave. This is where we can really add value,” says DeShazo. “We can help them visualize in a simple chart where all of their assets are going, which carries a lot of meaning for clients. It helps them fully realize the peace of mind of having everything in place.”

THE RESULT

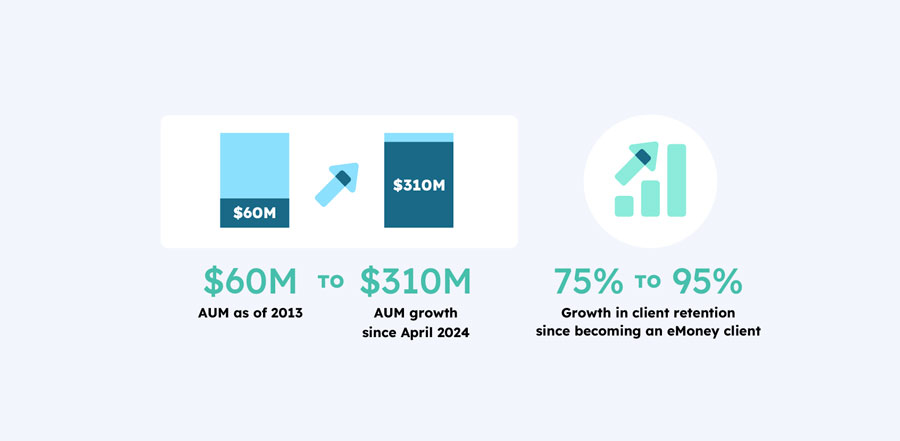

By closely collaborating with clients, addressing financial needs as they arise, and building each client a holistic financial picture, Waverly Austin is engaging and retaining clients at a high level.

Through the Client Portal, Waverly Austin is able to foster client involvement through digital check-ins on a schedule that works for each client’s preference. The Client Portal also allows them to curate reports, personalizing the experience by giving each client the information they care about most.

For Waverly Austin, eMoney is an essential solution in providing exceptional financial planning.

“We all want an engaged client, an energized staff, a repeatable customer experience, and a dependable process. eMoney allows us to do high-quality work, have everyone feel a part of the process, and provide a standardized process that gives each client their own unique experience.”