Case Study

Scaling Comprehensive Planning Across the Enterprise with eMoney

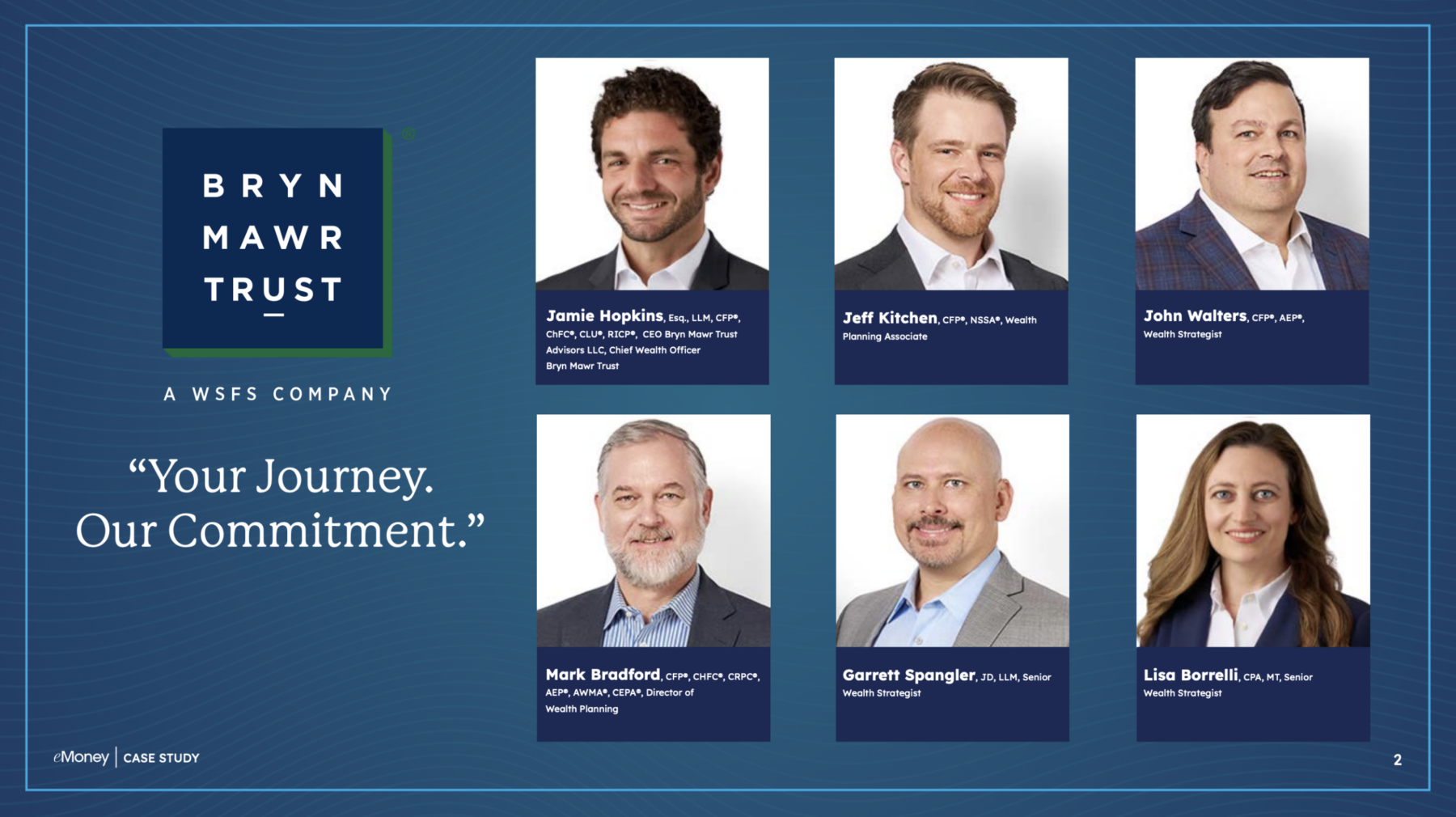

eMoney provides Bryn Mawr Trust with a one platform solution that helps the firm expand comprehensive wealth services while preserving exceptional client experiences.

The Goal

Bryn Mawr Trust (est. 1889) has a long history of trust administration and investment management, serving clients across the wealth spectrum, aligning their purpose with their wealth. Since merging with WSFS in 2022 (WSFS was founded in 1832), Bryn Mawr Trust Advisors has expanded regional banking and wealth services. As the firm grew, so did the demand for holistic wealth planning, inspiring the firm to undertake a transformative strategy to centralize and scale its extensive service offerings. However, this posed challenges as they sought to maintain the exceptional service their growing client base enjoys.

“We see eMoney as the core financial planning tool utilized across the firm to deliver a more comprehensive client engagement.” Mark Bradford, Director of Wealth Planning

Historically, Bryn Mawr Trust excelled at serving high-net-worth clients such as business owners, executives, and professionals, providing comprehensive services including investments lending, trust administration, and estate planning. As they expanded, the firm also wanted the flexibility to continue offering the capabilities of a large wealth firm, but with a personalized approach, and access to local advisory teams.

According to Director of Wealth Planning, Mark Bradford CFP®, ChFC®, CRPC®, AEP®, AWMA®, CEPA®, “It’s only been in the last 10 years that we’ve started driving more comprehensive planning,” and their key challenge was “making the complex simple and actionable for clients without sacrificing consistency or collaboration.”

To meet these objectives, the team set clear goals:

- Centralize financial planning support and processes.

- Establish advanced planning for advisors.

- Deliver dynamic, personalized advice.

- Integrate expertise from estate attorneys and tax professionals seamlessly.

- Scale planning across all advisors while prioritizing the client experience.

Chief Wealth Officer Jamie Hopkins Esq., LLM, CFP®, ChFC®, CLU®, RICP® noted that part of the challenge was finding a platform that could handle their clients’ needs because “very few firms can deliver the breadth of services that we can deliver: a personalized, multi-tiered offering where clients can grow.”

Very few firms can deliver the breadth of services that we can deliver: a personalized, multi-tiered offering where clients can grow.”

Jamie Hopkins Esq., LLM, CFP®, ChFC®, CLU®, RICP®

Chief Wealth Officer

The Solution

In 2015, Bryn Mawr Trust adopted eMoney as its primary financial planning hub, enabling real-time scenario modeling, collaboration, and comprehensive planning. Bradford notes the flexibility and scaling capabilities of eMoney makes for a perfect partnership:

“One size doesn’t fit all, and to be able to meet people where they are on their journey, and getting them to where they’re best served, that’s core to our values.”

Bryn Mawr Trust now uses robust eMoney capabilities to:

- Centralize its diverse wealth offerings—investments, trust administration, banking, estate—to deliver an integrated client experience using the platform’s Client Portal.

- Customize its services for diverse client needs, whether through turnkey solutions or collaborative partnerships with family offices, leveraging the adaptability of the eMoney platform.

- Conduct live scenario planning to help clients visualize outcomes like business sales or estate tax implications using the eMoney platform’s Decision Center.

- Collaborate with external advisors (estate attorneys, CPAs) during client interactions to ensure unified strategies, using the Vault to disseminate confidential documents to larger networks.

- Be the client’s trusted partner and help lead all financial conversations in alignment with unified strategies.

eMoney helps Bryn Mawr Trust deliver tailored guidance and seamless collaboration, meeting clients at every stage of their financial journeys with clarity and confidence.

The Result

It allows for us to be able to pull a client’s full financial picture aggregated in one place to ensure the best use of their resources and the most informed decisions.”

Lisa Borelli, CPA, MT

Senior Wealth Strategist

Today, the firm leverages eMoney to deliver comprehensive service offerings while still meeting every client exactly where they are at the start of the relationship. For some, that means beginning with the fundamentals of financial planning—clarifying goals, values, and other core priorities. For others, the entry point might be through Bryn Mawr Trust banking services or business planning solutions when doing exit planning.

“I think of eMoney as the core of the hub, and then you’ve got all these different opportunities that are unlocked from there,” says Bradford, touting the ability of eMoney to support the firm’s size and need for flexibility. “A client may start on the banking side and later transition into estate and financial planning, or the reverse.” eMoney enables Bradford’s team to seamlessly integrate diverse offerings, while creating a personalized experience that evolves over time.

By putting eMoney at the heart of its operations, Bryn Mawr Trust not only centralized its financial planning processes but also redefined its approach to holistic wealth planning. This innovation helped underscore Bryn Mawr Trust’s unwavering commitment to delivering personalized strategies and meaningful solutions, setting a new benchmark for trusted, client-centered financial services.

“Our whole job as financial planners and advice-givers is to help people sleep better at night. It’s about peace of mind, financial security, and living the life they want to live. eMoney opens the door for us to deliver that in a more meaningful way.” Jamie Hopkins, Chief Wealth Officer.

Disclosure

*Bryn Mawr Trust: $6.7B, Bryn Mawr Trust Advisors: $3.4B AUM and $788M AUA, The Bryn Mawr Trust Company of Delaware: $54B, WSFS Institutional Services: $28.5B as of September 30, 2025.

WSFS Bank Member FDIC. Wilmington Savings Fund Society, FSB d/b/a WSFS Bank. Private Banking is a division of WSFS Bank. Wilmington Savings Fund Society, FSB d/b/a/ Bryn Mawr Trust. Bryn Mawr Trust is a division of WSFS Bank. Bryn Mawr Trust Company of Delaware is a subsidiary of WSFS Financial Corporation. Products and services are provided through WSFS Financial Corporation’s subsidiaries and their affiliates. Trust and investment advisory services are offered through Bryn Mawr Trust. Bryn Mawr Trust is not a registered investment advisor. Investment advisory services are also offered through Bryn Mawr Trust Advisors, LLC (“BMTA”), an SEC registered investment advisor and a subsidiary of WSFS Financial Corporation. BMTA’s Registration as an investment advisor does not imply a certain level of skill or training. Bryn Mawr Trust does not provide legal, tax or accounting advice but those services may be provided by affiliates or subsidiaries of Bryn Mawr Trust.

INVESTMENTS: NOT A DEPOSIT, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY. NOT GUARANTEED BY THE BANK. MAY GO DOWN IN VALUE