Case Study

Growing AUM Almost 6x in 4 Years with eMoney

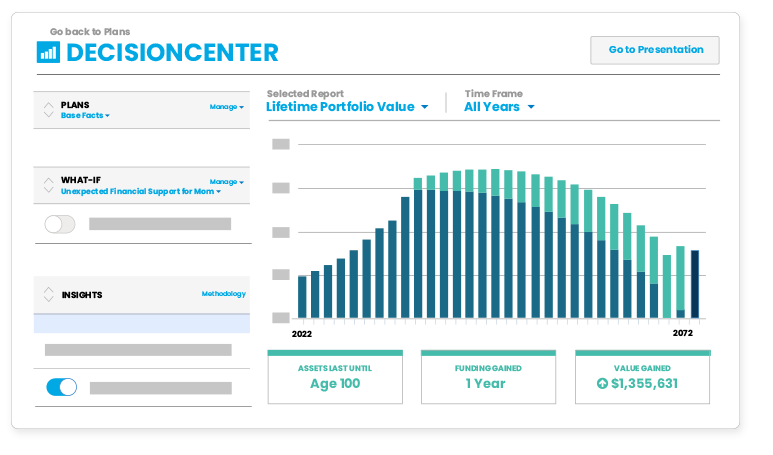

Beyond Your Hammock relies on the Decision Center, the Needs Analysis, and the Monte Carlo simulation within eMoney to communicate with clients in real time.

THE GOAL

Beyond Your Hammock is a fee-only financial planning and investment management firm helping clients take control of cash flow, set realistic goals, and invest appropriately for what they want to achieve. Its founder and lead financial planner, Eric Roberge, CFP®, explains the idea behind the firm:

“My intention was to help my peers manage their money so they could enjoy today and plan responsibly for tomorrow. No one should continually be forced to save money and experiences for retirement only.”

With a focus on busy professionals, Roberge knew he didn’t want a planning solution built singularly around retirement needs for his younger clients. He also knew that this digitally native market would expect a technology-driven planning experience to help them easily visualize how to achieve the best outcomes.

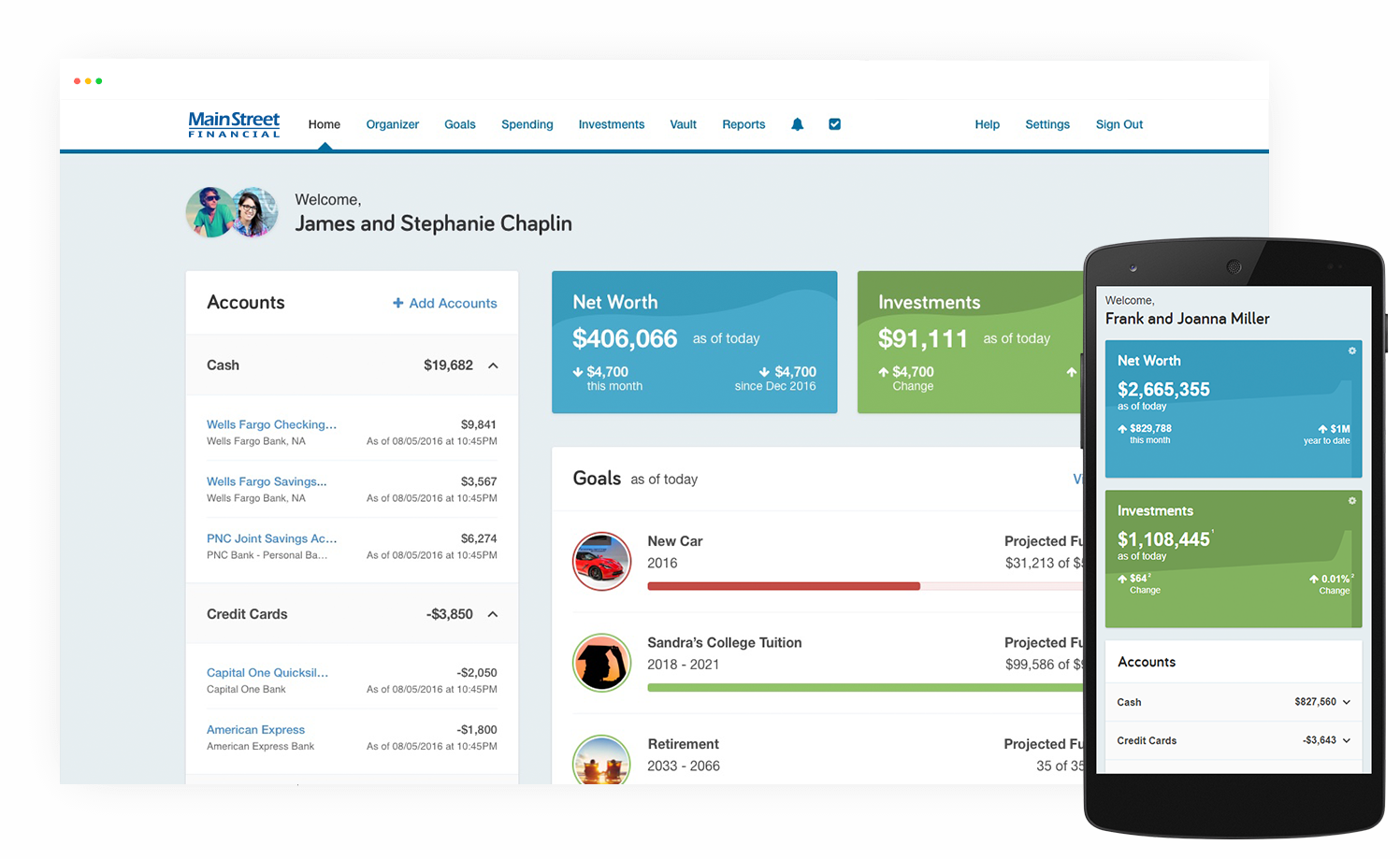

By supporting clients earlier in life, when wealth is accumulating and cash flow is a main concern, planning needs are constantly evolving. For Roberge, the combination of the eMoney Client Portal and the dynamic nature of the planning software that facilitates deeper conversations around both short- and long-term goals made it a best-in-class solution for his business.

“When I started working with clients in 2013, they were mainly concerned about cash flow. But in just a few years, their financial situations became much more complex, and eMoney could handle that evolution.” – Eric Roberge

THE SOLUTION

Roberge and his clients benefit from convenience and flexibility with eMoney when it comes to engaging with their plans. Clients have access to their financial pictures at all times through their portal and actively engage with it. Roberge reports, “Over 95% of our clients utilize their financial portal.”

And during the pandemic when everyone was remote, Roberge was able to conduct all client planning meetings over video conference by sharing the eMoney platform—allowing his clients to connect with him wherever they were.

Clients often have many moving pieces in their financial lives and competing priorities. That’s where eMoney comes in. Roberge says one of its main benefits is in how it takes the intangible in a client’s cash flow and balance sheet and depicts the changes over time in a visual, interactive way.

To do this, eMoney is the hub of all client-specific interactions with the plan. It serves as the grounding mechanism to align all parties on the financial reality of their situation, capturing their near and long-term view.

Roberge reinforces that his firm’s role is to focus on helping clients understand what really moves the needle, what they should be aware of, and what decisions they need to make right now to achieve the stated goal.

He relies on the Decision Center, the Needs Analysis, and the Monte Carlo simulation within eMoney to communicate in real time. These tools help his clients make informed decisions about how to leverage their resources, prioritize across multiple savings and investment goals, and strategically grow their wealth and investable assets along the way.

“They are trying to balance saving for their children’s college with saving for their own future, and there’s a fine line for saving in the college category and bankrupting your own retirement. Being able to model the different scenarios with the eMoney Decision Center helps to illustrate the long-term impact of those choices.” – Eric Roberge

THE RESULT

Working with a target audience has built up Roberge’s expertise in advanced tax and income planning. For many of these professional clients their income is represented as an annual salary, but there are variable pieces such as bonuses, commissions, or equity that must be managed as well. Delivering more sophisticated planning has positioned Roberge to attract clients with higher income. And with eMoney he can clearly articulate his value to be able to increase planning fees over time.

During meetings throughout the year—and over the long term—Roberge can track and share the impact of the planning, and the growth of his clients’ assets within their eMoney reports. Whether the look back is a year later or five years later, he can show them very clearly the progression and it’s a historical picture of the relationship.

Over a four-year period using eMoney, Beyond Your Hammock increased 12-month, forward-looking recurring revenue 334%.

eMoney provides Roberge with a win-win: His business continues to grow and expand with the scale of high touch planning technology helping him do more with less time, and his clients get to cash in on his promise to give them peace of mind around their finances.

“The net worth statements and cash flow reports in eMoney are an opportunity to show clients how we’re continually adding value. Having those kinds of checkpoints reinforces what’s being delivered and shows that the plan is evolving as their needs are.” – Eric Roberge

See What’s Possible with eMoney

Are you in need of a solution that enables the deep analysis and comprehensive planning functionality you need to serve the complex needs of your current and future clients?