Case Study

Using eMoney as a Financial Planning Differentiator

CURO Financial uses eMoney to provide financial planning through their EKG philosophy—imparting Education and Knowledge about retirement and offering Guidance every step of the way.

THE GOAL

Founded in 2016 by Jim Lingelbach, CFP®, ChFC®, CLU, RICP, BFA, CASL® and Ciano Villaquiran, CFP®, ChFC®, CLU, BFA, CURO Financial and Insurance Solutions specializes in helping its clients navigate the retirement transition.

CURO Founders Jim Lingelbach, CFP®, ChFC®, CLU, RICP, BFA, CASL® and Ciano Villaquiran, CFP®, ChFC®, CLU, BFA

The CURO team believes that their best value—and greatest success—lies in financial planning. They take the time to get to know each client to learn what matters most to them so they can serve as a trusted advisor for life’s big decisions and everyday concerns.

Villaquiran shares,

“When your goal is to dive deeper into your relationship with clients, you have to have a platform that really promotes and drives the planning discussions and eMoney provides that.”

CURO Financial’s goal is to be a partner, to relieve financial stress, and to help their clients attain the freedom to enjoy the life and activities that make them happy—and they achieve this through their expertise and focus on financial planning.

THE SOLUTION

CURO has used eMoney since the firm’s inception—the founders knew it was the tool they needed to provide truly comprehensive financial planning.

The firm undoubtedly believes that eMoney enhances retirement planning by enabling comprehensive scenario analysis and stress testing. They make particular use of eMoney for building out recommended plans and checking them against alternative recommendations, while running Monte Carlo analyses to demonstrate the plan’s resilience. The team enhances client communication by generating easy-to-understand reports and conducting interactive presentations in Decision Center.

Villaquiran notes…

“We are increasingly using Decision Center in client meetings. Whereas before we would get updated numbers during a meeting and adjust [the plan] afterward to share with the client, using Decision Center to update and share those numbers during the meeting really allows us to expedite the discussion. It enhances the immediate conversation and helps speed up our timeline.”

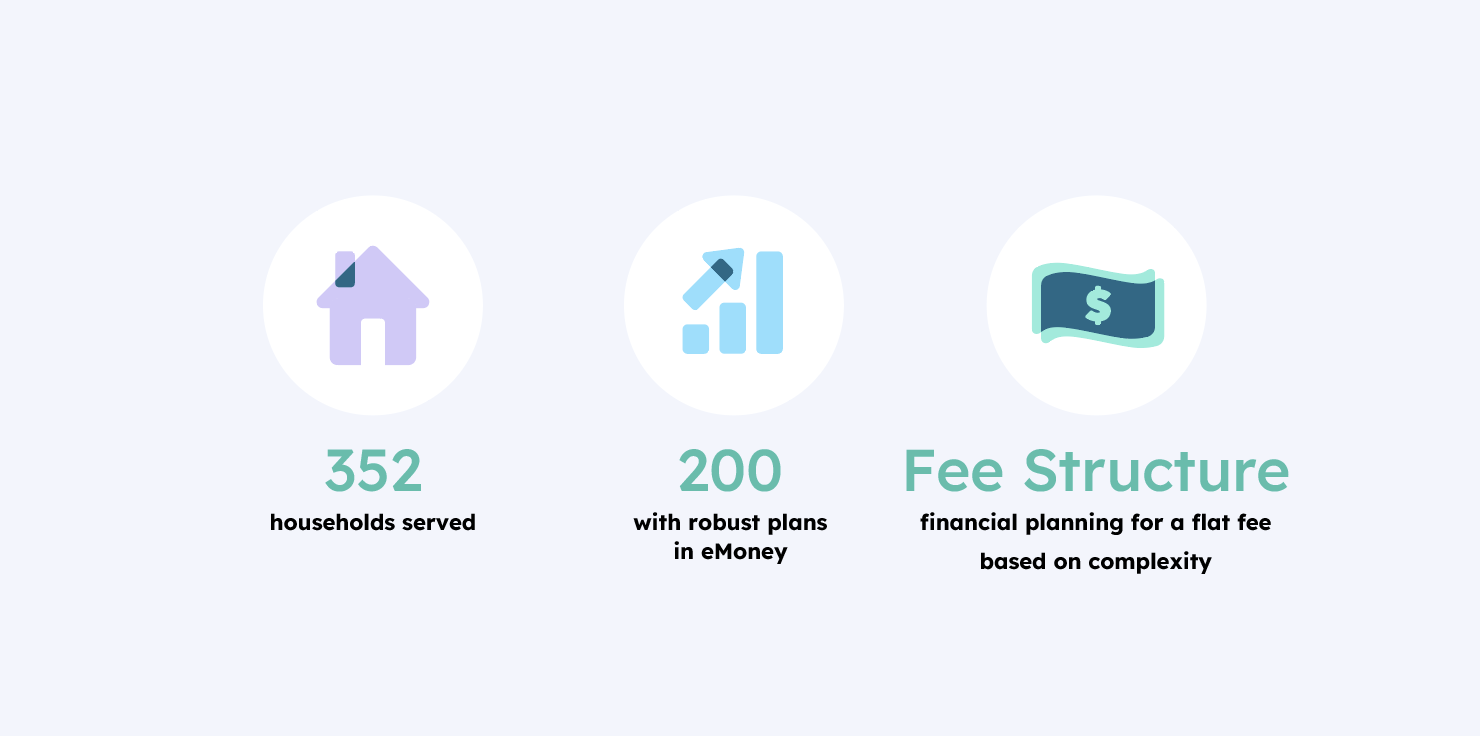

THE RESULT

The CURO team believes that eMoney allows the firm to specialize in planning. The partners directly credit eMoney as a key driver of their firm’s success and ability to deliver a true planning-centric experience. Having sophisticated yet user-friendly planning software has allowed them to build robust processes, customize advice for complex scenarios, involve clients throughout the planning journey, and deliver standout service.

CURO believes they offer a differentiated planning service because of their ability to illustrate recommendations in an engaging visual manner, provide in-depth analysis that gives clients confidence in their plan, and continuously improve their approach over time as eMoney capabilities evolve.

My team does very in-depth plans, and eMoney is the perfect tool to use for that. Clients love the visual element—it brings them the peace of mind that they will be able to achieve their goals.”

Luciana Macedo, CFP®, BFA

Behavioral Financial Advisor (BFA)