Our extensive financial planning solutions empower you and your clients to take action, see impact, and celebrate wins, together.

Achieve your goals and theirs with eMoney

We’re here to help you build the plan your clients need, regardless of their financial situations.

When I started, my clients were mainly concerned about cash flow. But in just a few years, their financial situations became much more complex, and eMoney could handle that evolution. ”

Eric Roberge, CFP®

Beyond Your Hammock

Product Capabilities

-

Monte Carlo Analysis

Leverage the ability to plan for every possibility and eventuality.

-

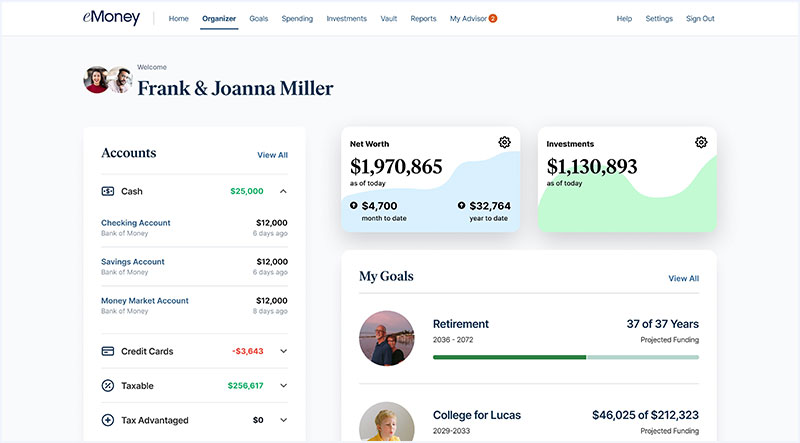

Account Aggregation

Bring together all of your client’s financial information to see it all in one place.

-

Client Portal

Build an always-on connection to your clients between meetings, with 24/7/365 access to important updates and documents.

-

Decision Center

Deliver an interactive experience that will uncover the needs and potential pitfalls for every type of client.

-

Plan Summary

Develop a personalized and custom experience that scales with you and your clients’ needs.

A streamlined, goals-based financial planning solution for building more planning relationships and delivering more plans to more clients.

The most comprehensive cash flow-based financial planning solution for addressing clients’ most complex planning needs.

Goals-based and cash flow planning tools in a single platform that enables planning for all clients regardless of financial situations.

Lean on our 20+ years of experience delivering planning-led solutions to financial institutions of all sizes and take your planning business to the next level.

See what’s possible with eMoney

Are you searching for a solution that enables the deep analysis and comprehensive planning functionality necessary to serve the complex needs of your current and future clients?

*All statistics on this page are from eMoney, ROI of eMoney Study, December 2023, n=701.