Case Study

A Deeper Vision for Financial Planning with eMoney

Third Eye Associates uses eMoney to provide Financial Life Planning, Financial Transition Planning, and Wealth Management strategies to help clients realize their greatest asset—a rewarding life.

THE GOAL

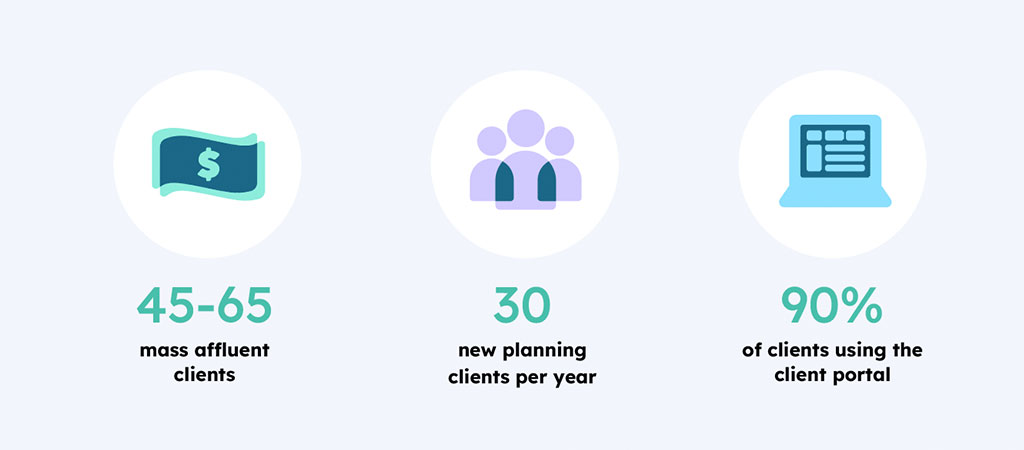

When Beth Jones, RLP®, AIF®, CeFT®, founded Third Eye Associates, she was frustrated by an industry she felt lacked client focus. She set out to combine the deep work of life planning and the ongoing work of financial planning to provide a more holistic, transformative experience for her mass affluent clients.

Today, Jones has a 6-month long life planning process to establish relationships, while she builds the financial plan in the background. The goal is to help clients zero in on what they truly want to achieve in life, then understand how their current financial decisions are helping or hurting their progress.

“We guide clients to see where their money is going and understand the impact on their long-term goals, We show them the facts so they can make informed decisions. We want clients to own their plan, not look to us for the answers.”

– Beth Jones, RLP®, AIF®, CeFT®

To create this type of planning experience, Jones needed a platform that would give clients insight into their own behaviors, empowering them to change. She chose eMoney because it allowed clients to visualize the financial impact of their decisions, all within an engaging, personalized portal experience.

We wanted to give clients an infrastructure that would help them be successful,” she said. “We needed a tool that let clients monitor their finances so they can keep themselves on track.”

Beth Jones, RLP®, AIF®, CeFT®

President & Founder

THE SOLUTION

Cash flow planning is at the heart of Third Eye’s planning services. With every client, Third Eye illustrates their cash flow by category, uncovers where their cash is going, then works with the client to help them move toward the vision they’ve established together in their life planning work.

Total client engagement is the key to enacting positive change. To achieve this level of engagement, Jones and her team rely heavily on the eMoney Client Portal.

To encourage adoption, the Third Eye team conducts tutorials with every client. “We realized how powerful the client portal is when we taught people how to use it. It’s ingrained in what we do now. People need to know how much it costs to live a year in their life. They need to know the bottom line, and this is a great way to show them.”

“Our clients love the Client Portal. Once they start using it, they’re delighted. It becomes an integral part of their success in managing their finances.”

– Beth Jones, RLP®, AIF®, CeFT®

With all accounts connected and cash flow clarified, Jones says that “clients are now in the game, not in the stands observing.” They’re addressing their cash flow, they’re thinking about reducing their overhead in retirement, and they’re making the right choices to achieve the goals they’ve set.

The Vault plays an important supporting role in this process. Early in the relationship, Jones sets the expectation that all documentation and related communication should happen through the Vault, assuring clients that this is the safest way for them to share and store their sensitive information.

THE RESULT

The results for Jones and Third Eye are, simply put, remarkable client successes.

“We have clients calling us with ideas for their plan, because of their relationship with the Client Portal, they are fully engaged in their plan and they’re owning it, which to us is a major success.”

– Beth Jones, RLP®, AIF®, CeFT®

When clients own their plan, they’re in control of their spending, and Jones says they consistently report gaining peace of mind they never had before. Even if they’re still struggling to save, there’s a great sense of relief in knowing where their money is going.

Through the life planning process, Jones can understand her clients’ deepest motivations and the obstacles to living in alignment with those motivations. Through eMoney’s cash flow insight, Jones can understand how all of this may be reflected in clients’ spending habits.

Ultimately, she builds a vision with clients that truly reflects what they want, and together they create an effective roadmap to achieve this vision. eMoney helps Jones create an excellent client experience, where detailed cash flow analysis, a collaborative portal, and deep life planning work all combine to create transformative results for clients.

See What’s Possible with eMoney

Are you in need of a solution that enables the deep analysis and comprehensive planning functionality you need to serve the complex needs of your current and future clients?