Case Study

Elevating the Planning Experience for Generations of Clients

Winthrop Wealth, a long-time eMoney client, combines legacy leadership with the tech-forward second generation to grow to $1.85B in AUM.

THE GOAL

Winthrop Wealth has strived to serve clients’ best interest since day one. But to continue offering consistent service, they recognized the need to reevaluate the firm’s structure and scalability. The next generation of the family firm, Earl’s sons—Lucas and Max Winthrop, lent a fresh perspective to the future growth strategy.

“As the need for advice grows, there is a tremendous opportunity for fee-based, advice-centric firms like ours to innovate. We decided to create a financial planning experience that would deepen the level of service and engagement offered to clients. Relationships are critical, but so is creating value,” – Lucas Winthrop

By combining legacy leadership with the tech-forward second generation, Winthrop Wealth was positioned to create continuity for its current clients while driving sustainable growth with next-generation clients.

To do this, the firm needed to formalize its team structure, create a consistent and repeatable service experience, and scale its core offering of financial planning.

We turned to technology to support our goals and lead us into a new age of growth for our firm.”

Lucas Winthrop

Chief Operating Officer

THE SOLUTION

Lucas and Max conducted extensive reviews to ensure eMoney could handle their evolution to attract more clients by offering a comprehensive planning experience.

“When we conduct our technology evaluations, we look beyond the typical functionality of a system to the overall health of the company—security protocols, long-term vision, ability to innovate, and more,” affirms Lucas. “With eMoney API integrations, you can connect a lot more information into the system, which is huge.”

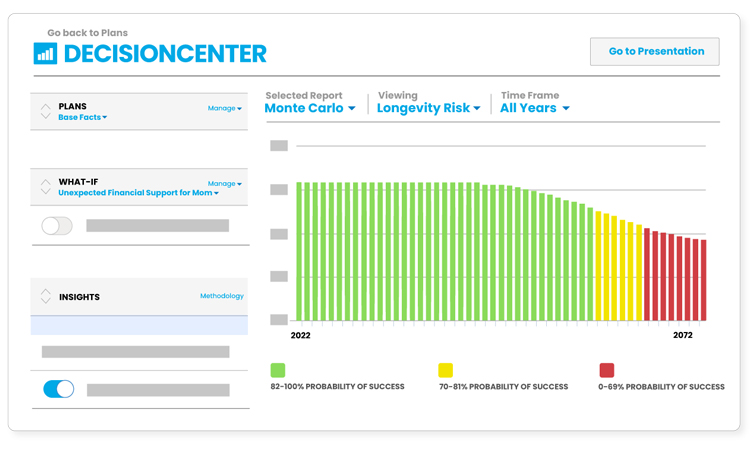

eMoney is the backend to any annual review, planning update, or onboarding conversation with clients—from anywhere. In particular, their advisors use the eMoney Decision Center to drive planning forward. Presenting scenarios in Decision Center is an impactful, visual experience. Clients immediately grasp how value can be created or lost based on their financial decisions. It’s the foundation for real-time, collaborative financial planning.

With the right platform in place, the team turned its attention to process by defining and documenting their planning methodology in a series of playbooks to guide staff. This seeks to ensure a repeatable, high-quality client experience.

“If we hire a new planner tomorrow, the playbook shows them exactly how we approach and execute planning in eMoney, from the data we input to the outputs we create. It helps us to meet the high expectations our clients have and maintain our excellent client retention rates, which was an especially important consideration when increasing our reliance on technology,” Lucas says.

“Strong technology choices have helped us transform into a true ensemble model where the advisor cultivates more intimate client relationships.” – Max Winthrop

THE RESULT

With investments in human capital and fully optimized and integrated tech, Lucas and Max are guiding their multigenerational team to offer comprehensive wealth management to generations of families. Their tech-forward approach hasn’t diluted the firm’s value proposition of putting clients first, instead, it enhances it. Winthrop Wealth isn’t looking for one type of client with an investable minimum. They are seeking disciplined clients who align with them philosophically and on a value basis.

Partnering with eMoney has helped highlight their advice-centric philosophy and formalize the financial plan from the outset of the client relationship. In eMoney, advisors can create a comprehensive picture to serve their clients’ needs—at every stage of life. This has helped the firm extend their relationships beyond the primary head of household to the whole family.

Being a planning-led firm has proven effective in attracting the next generation of clients and advisors as well. Lucas says,“By leveraging technology to build transparency and internal efficiency, our team is empowered to support clients at elevated levels. We have really specialized roles that allow our team to go deep into their subject matter expertise.”

The commitment and varied knowledge of a multigenerational team has cultivated a great client experience, and it has given some of that precious commodity—time—back to their advisors. Aided by eMoney and a thoughtful generational strategy, the firm is on track to maintain its client relationships for years to come and sustain growth by serving the next generation of advice-seeking clients.

Disclosures

Securities offered through LPL Financial. Member FINRA/SIPC. Investment Advice offered through Winthrop Wealth, a Registered Investment Advisor and separate entity from LPL Financial.

The following article could be viewed as an endorsement of Winthrop Wealth (“WW”) by eMoney. Here is some important information for you to understand about our relationship with eMoney.

• eMoney is not a current client of WW. eMoney is a provider of financial planning software to investment advisors and other financial professionals.

• WW does not pay to endorse or refer potential clients to WW for investment advisory services. However, WW does pay eMoney a normal and customary annual subscription fee for the use of their software.

• In addition, WW may refer other investment advisors and financial professionals to eMoney as potential subscribers. This cross-referral opportunity presents a conflict of interest in that eMoney has a financial incentive to endorse WW in exchange for potential referrals.

See What’s Possible with eMoney

Are you in need of a solution that enables the deep analysis and comprehensive planning functionality you need to serve the complex needs of your current and future clients?