A Workflow to Create a Workflow: Building Efficient Financial Planning Processes

In a world where client expectations, technology, and regulations are constantly evolving, financial planners need workflows that don’t just sit… Read More

Insights and best practices for successful financial planning engagement

• Tobias Donath • December 4, 2025

For the last 13 years of my career, I’ve spent a lot of my time working with and coaching financial advisors on how to engage clients’ families, understanding their challenges, and observing first-hand what drives their growth. One theme that comes up again and again is time. Or, more accurately, the lack of it. But, what if I told you that a focus on finding five hours could be all it takes to make a meaningful business impact?

It’s easy to treat time like a fixed constraint. There are only so many hours in a day. Over the years, I’ve observed how the most successful individuals don’t just work harder—they work smarter. They understand that growth isn’t just about effort; it’s about how you align your time to the activities that matter most.

This is especially critical in the financial advisory space, where the demands of clients are growing more complex, financial advisors are stretched thin, and the opportunities for meaningful engagement are expanding. Fidelity’s research shows that advisors spend only four of every ten hours supporting clients and prospects, while the remaining six hours are consumed by administrative tasks, compliance, or other non-client-related duties. This imbalance not only limits growth, but can also contribute to burnout.

Fidelity’s analysis shows that re-allocating five more hours each week to clients and prospects could lead to an increase of 27% in annual revenue.1 For an advisor that currently generates $1M in annual revenue, this could mean an additional $270K each year.1 Imagine how that could impact your growth and the experience your clients have.

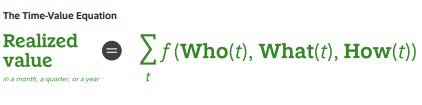

The numbers are compelling, but the real challenge lies in execution: How do you free up those hours and ensure they’re spent effectively? Fidelity designed a framework to help financial advisors optimize their time: the Time-Value Equation. It suggests that the value (or the growth) that one creates over time is determined by three elements:

Let’s explore each of these elements in more detail.

Not all relationships are created equal. Data shows that less profitable clients represent 42% of the average advisor’s book, but occupy an equivalent amount of their time (39%).2 Meanwhile, high-net-worth households continue to amass wealth—representing an opportunity for advisors with the capacity and capabilities to serve them. For example, 2/3 of the wealth created between 2011 and 2022 in the U.S. went to the ~2% of households that have $5 million or more in investable assets.3 Not every advisor aspires to serve the wealthy or very wealthy. But, for those that do, these clients have more complex needs and will require more time from their advisors.

It’s not just about targeting high value clients; it’s about engaging more broadly in their complex needs, which include their families. Wealth transitions can be a critical moment in a client relationship, yet many advisors miss the mark by not establishing relationships with heirs before a transition occurs. For example, surveyed advisors have not met 25% of their clients’ spouses/partners and 70% of their clients’ adult children (on average). When families are engaged, the advantages are clear. According to Fidelity’s analysis of thousands of client accounts, advisor-managed assets are twice as high, and revenue is nearly double for a household where the spouse and the next generation are engaged, compared to a household where only the primary client is engaged.4

In recent years, clients have been asking for more than investment management advice. While managing money is the foundation of most client relationships, it’s also a very crowded space. Advisors may have additional opportunities to differentiate and expand the assets they manage by addressing clients’ broader needs—helping them realize their goals, find peace of mind, and even achieve personal fulfillment.

For example, retirement planning is evolving. The traditional model of full retirement at age 65 is giving way to the “encore era,” where individuals pursue phased retirement, part-time work, or remote opportunities.5 Yet only 26% of millionaire clients say their advisor helps them think about how to spend their time in retirement.6

Similarly, healthcare planning is becoming increasingly important. Americans are spending an average of 16 years in poorer health later in life7, and health care and medical costs are estimated to be over $172K for a 65-year-old retiring in 2025.8 Advisors can add significant value by helping clients anticipate and plan for healthcare costs and major life events. Yet only 8% of millionaire clients say their advisor has spent time on these topics.6

Finally, there’s the question of how time is spent. While advisors cite a lack of time as their top obstacle to growth, only 34% of those surveyed say they carefully manage their time. This is where technology, delegation, and outsourcing can play a transformative role.

Advisors who effectively outsource investment management to a third-party or their home office save an average of seven hours per week, and those who outsource marketing tasks are saving almost four hours per week. Despite these benefits, few advisors are leveraging these proven practices. A recent Fidelity survey showed that just 21% of surveyed advisors feel they delegate or outsource effectively.

Strategic business planning is another overlooked tool. Surveyed advisors with a written business plan report 50% higher organic growth rates than those that don’t have one. Yet only 43% of advisors have a written plan.

Without a plan, it’s hard to know where to spend your time.

To put these insights into action, consider the following steps:

What I appreciate about the Time-Value Equation is that it doesn’t tell you what to do. It invites you to reflect, prioritize, and act with intention. It’s about aligning your time with your goals and values. When you start treating time as your most valuable asset, you can unlock the potential to serve your clients better, and build a practice that’s equal parts: sustainable, fulfilling and growing.

Sources:

1 Fidelity analysis. Sources: The 2025 Fidelity Advisor Insights Study and the 2024 Fidelity RIA Benchmarking Study. $1M is the median annual revenue/advisor for $1B+ AUM firms. See sources section for more details.

2 The 2024 Fidelity Financial Advisor Community – Industry Trends Survey. See sources section for more details.

3 The Cerulli Report—High-Net-Worth And Ultra-High-Net-Worth Markets 2023, Cerulli Associates.

4 The Fidelity Client Insight Tool is a client engagement and aggregation of 90+ firms and over 125K lines of data presented by households. Data was collected from 2019 to June 2023 by the Fidelity Practice Management & Consulting team. The information contained in, and the data generated by the Client Insight Tool are hypothetical in nature, for informational purposes only, and may not reflect your (or your client’s) particular situation.

5 The Fidelity Participant and Plan Sponsor Survey, The Evolving Landscape of Retirement, July 2024. See sources section for more details.

6 The 2025 Fidelity Investor Insights Study. See sources section for more details.

7 Garmany, A.; Terzic, A. (2024) Global Healthspan-Lifespan Gaps Among 183 World Health Organization Member States, JAMA Network Open.

8 Estimate based on a single person retiring in 2025, 65-years-old, with life expectancies that align with Society of Actuaries’ RP-2014 Healthy Annuitant rates projected with Mortality Improvements Scale MP-2020 as of 2022. Actual assets needed may be more or less depending on actual health status, area of residence, and longevity. Estimate is net of taxes. The Fidelity Retiree Health Care Cost Estimate assumes individuals do not have employer-provided retiree health care coverage, but do qualify for the federal government’s insurance program, original Medicare. The calculation takes into account Medicare Part B base premiums and cost-sharing provisions (such as deductibles and coinsurance) associated with Medicare Part A and Part B (inpatient and outpatient medical insurance). It also considers Medicare Part D (prescription drug coverage) premiums and out-of-pocket costs, as well as certain services excluded by original Medicare. The estimate does not include other health-related expenses, such as over-the-counter medications, most dental services and long-term care.

All data points were derived from The 2025 Fidelity Advisor Insights Study, unless specifically noted. Survey details follow.

The 2025 Fidelity Advisor Insights Study was an online blind survey (Fidelity not identified) and was fielded during the period February 18 through February 26, 2025. Participants included 479 advisors who manage or advise upon client assets either individually or as a team, and work primarily with individual investors. Advisor firm types included a mix of banks, independent broker-dealers, insurance companies, regional broker-dealers, RIAs, and national brokerage firms (commonly referred to as wirehouses), with findings weighted to reflect industry composition. The study was conducted by an independent firm not affiliated with Fidelity Investments.

The 2025 Fidelity Investor Insights Study was conducted during the period February 7 through February 25, 2025. It surveyed a total of 2,018 investors, including 998 Millionaires and 1,215 investors with advisors. The study was conducted via an online survey, with the sample provided by an independent firm not affiliated with Fidelity. Respondents were screened for a minimum level of $50K in investable assets (excluding retirement assets and primary residence), with additional quotas by age and affluence levels.

Fidelity Participant and Plan Sponsor Survey, The Evolving Landscape of Retirement research was conducted from May 31 through July 2, 2024. A total of 10,517 employees and retirees were surveyed, all of whom have or had an employer-sponsored retirement savings plan. A total of 1,001 HR professionals directly involved in workforce strategy, talent acquisition, and knowledgeable about the company’s benefits strategy and workforce strategy were also surveyed. The study was conducted via an online survey, with the sample provided by CMI, a third-party firm not affiliated with Fidelity. Reported base sizes are unweighted.

The 2024 Fidelity Financial Advisor Community – Industry Trends Study was an online blind survey (Fidelity not identified) and was fielded during the period February 2 through February 15, 2024. Participants included 432 advisors who manage or advise upon client assets either individually or as a team, and work primarily with individual investors. Advisor firm types included a mix of banks, independent broker-dealers, insurance companies, regional broker-dealers, RIAs, and national brokerage firms (commonly referred to as wirehouses), with findings weighted to reflect industry composition. The study was conducted by an independent firm not affiliated with Fidelity Investments.

The 2024 Fidelity RIA Benchmarking Study was conducted between February 5 and April 19, 2024; 310 firms participated. The study was administered online by an independent third-party research firm not affiliated with Fidelity. Fidelity was identified as the sponsor of the study. The experiences of the RIAs who responded to this study may not be representative of the experiences of other RIAs and are not an indication of future success.

eMoney Advisor LLC is a Fidelity Investments company and an affiliate of Fidelity Brokerage Services LLC and National Financial Services LLC.

Fidelity Investments® provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC

DISCLAIMER: The eMoney Advisor Blog is meant as an educational and informative resource for financial professionals and individuals alike. It is not meant to be, and should not be taken as financial, legal, tax or other professional advice. Those seeking professional advice may do so by consulting with a professional advisor. eMoney Advisor will not be liable for any actions you may take based on the content of this blog.

The views and opinions expressed by this blog post guest are solely those of the guest and do not necessarily reflect the opinions of eMoney Advisor, LLC. eMoney Advisor is not responsible for the content, views or opinions presented by our guest, nor may eMoney Advisor be held liable for any actions taken by you based on the content, views or opinions of the guest.

You may also be interested in...

In a world where client expectations, technology, and regulations are constantly evolving, financial planners need workflows that don’t just sit… Read More

If your institution’s advisors have traditionally focused on sales rather than planning, you might be facing a common challenge: resistance… Read More

A financial planner’s time is precious, and chances are, you sometimes feel like you’re not squeezing all the juice out… Read More

Download this eBook now and learn how AI is expected to impact the industry.

Download Nowa new source of expert insights for financial professionals.

Get StartedTips specific to the eMoney platform can be found in

the eMoney application, under Help, eMoney Advisor Blog.