5 Ways to Help Clients Build Financial Resilience

Financial planning is most effective when it accounts for the realities of change, uncertainty, and transition. Markets shift, careers evolve,… Read More

Insights and best practices for successful financial planning engagement

• Emily Koochel • October 16, 2023

For today’s financial planner, delivering a plan is table stakes, and providing a personalized planning experience is no longer just a “nice to have”, but essential in meeting evolving client expectations. Financial professionals who want to garner client trust, loyalty, and satisfaction—must be willing to go beyond the plan.

In eMoney’s 2023 Summit Research, we looked to explore the space beyond the plan, where technology, financial psychology, and commitment to service meet. We sought to uncover opportunities for advisors to enhance their value and provide the personalized experience their clients are seeking.

Gathering both advisor and end-client perspectives, the results reveal how the application of technology, specifically client portal technologies, and financial psychology can improve client outcomes.

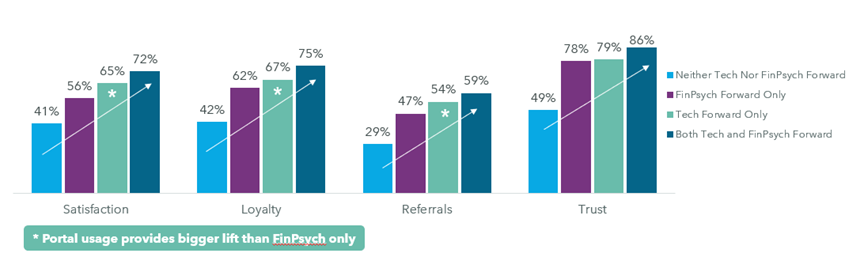

For financial advisors, the choice between embracing technology or shying away from it holds significant implications. Clients who work with tech-forward advisors—defined as those who rate technology (client portals) as very or extremely important and are actively using it in their planning process—experience improved satisfaction, heightened motivation, and increased trust.1

Similarly, clients of FinPsych-forward advisors—those who believe financial psychology is very or extremely important and have adopted six or more FinPsych actions into their practice—also saw improved client outcomes. 1

The real power, however, lies in the use of both technology and financial psychology. This combination results in a better client experience, elevated overall satisfaction, and enduring client loyalty. 1

While these results are powerful, an even greater opportunity remains, as only 17 percent of advisors have fully embraced this dual approach. 1

Our research tested 21 ‘finpsych’ actions and found that incorporating principles from financial psychology into your advisory practice can significantly enhance a client’s overall satisfaction. For example, taking time to discuss a client’s family history, sources of financial stress, cultural values, and understanding their financial priorities, allows you to better understand—and plan for—all aspects of a client’s financial life. While the average financial advisor engages in eight financial psychology actions, we also discovered that not all actions have the same effect on client satisfaction. 1

Out of the 21 actions we tested, here are the top five practices that have the greatest positive impact on a client’s overall satisfaction: 1

While this list might appear extensive, our results also showed that adopting just one of these actions improves client satisfaction, and with each subsequent action there is a consistent and substantial rise in overall satisfaction. 1

And while we know many advisors are doing one or many of these, there is still opportunity for improvement. When we asked end-clients about the frequency with which their advisors are taking these actions, their responses indicated that it averages to less than 50 percent of the time.

The technology that tech-forward advisors are using to achieve these results is a client portal. In fact, clients are benefitting from the client portal more than advisors may realize—results show that overall satisfaction increases as client portal use increases. Our research showed that 66 percent of clients have access to a portal, and almost half of those are frequent users, netting 30 percent of end-clients as active portal users.

Here are the client portal features that clients are reporting are most important:

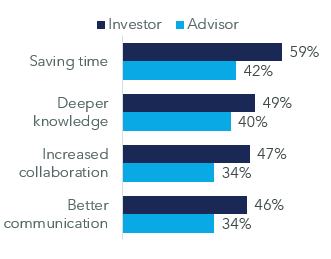

In addition to these features, clients reported that the client portal increases their collaboration and engagement with their advisor, ultimately deepening their knowledge of personal finance and their relationship with their advisor through better communication.

While there are many benefits of adopting financial psychology tactics and technology, there are two outcomes that directly impact your bottom line: referrals and client loyalty.

Clients working with advisors who embrace financial psychology generate nearly 2.5 times more referrals annually compared to those with advisors who are less attuned to financial psychology. Moreover, a substantial 68 percent of these clients strongly express their commitment to maintaining a long-term relationship with their financial advisor. 1

From a technological perspective, clients actively utilizing a client portal demonstrate remarkable loyalty. Fifty-six percent of clients who use their client portal frequently are referring their advisor two times more per year. Furthermore, an impressive 70 percent of these clients intend to uphold their relationship with their advisor, affirming their loyalty. 1

These outcomes underscore the significance of integrating financial psychology and leveraging technology in your practice for tangible bottom-line benefits.

While the advantages of technology have long been known (e.g., automation, efficiency, etc.), our research shows that aptitude in both financial psychology and the adoption of technology, specifically the client portal, is imperative for financial advisors to provide and meet client expectations.

Through the use of client portals, we see significantly better reported outcomes for overall client satisfaction, highlighting the intrinsic value of the technology, but we also see outcomes that speak directly to the bottom line in terms of retention and referrals, showing the multifaceted impact of improving client engagement and planning experiences.

Sources:

1.eMoney Beyond the Plan Research, July 2023, n=504 advisors, n=1,003 end-client investors

You may also be interested in...

Financial planning is most effective when it accounts for the realities of change, uncertainty, and transition. Markets shift, careers evolve,… Read More

The rise in wealth controlled by women1 signals one of the most significant demographic shifts in the industry, yet many… Read More

Financial planners face challenges that few outside the industry truly understand, including maintaining relationships, keeping pace with new technologies, staying… Read More

Download this eBook now and learn how AI is expected to impact the industry.

Download Nowa new source of expert insights for financial professionals.

Get StartedTips specific to the eMoney platform can be found in

the eMoney application, under Help, eMoney Advisor Blog.