Personalize Client Communications for Better Retention

Our research continues to support the fact that clients are seeking a personalized financial planning experience.1 To fully achieve this,… Read More

Insights and best practices for successful financial planning engagement

• Rohit Mahna • December 9, 2024

According to Fidelity’s 2024 Investor Insights Study, a significant majority of Millennials (Gen Y) and Gen Z (61 percent) and half of Gen X (51 percent) are seeking services that extend beyond traditional money management. Investors today are contending with a multitude of challenges: safety, health, family concerns, and the ever-looming issue of financial stability. For advisors looking to connect with Gens XYZ, establishing strong relationships will be foundational in addressing the different priorities and heightened expectations of these generations.

Given this backdrop, Fidelity’s latest Investor Insights Study reveals three key actions advisors can take to establish stronger relationships with these generations.

Modern investors are increasingly worried about a diverse array of issues that go far beyond just their portfolios. From managing healthcare expenses to dealing with long-term care and unexpected medical costs, investors are concerned about keeping up. Their personal financial safety and that of their families is also an emerging concern.

These worries are compounded by worries about money. The pressure to constantly improve their financial situation is felt by many, with 62 percent of Gen YZ and 50 percent of Gen X stating they are always anxious about money, regardless of how much they have.

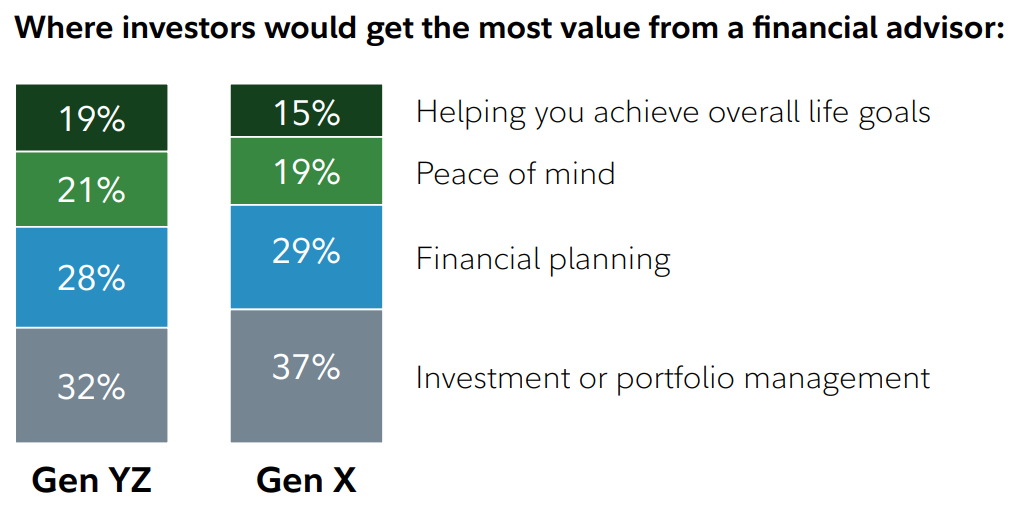

Advisors could consider using these insights to build stronger relationships with clients, especially by focusing on delivering value where clients want it. While investment management continues to be seen as the most valuable service provided by advisors, Fidelity’s findings indicate that about two-thirds of an advisor’s perceived value is attributed to comprehensive financial planning, offering peace of mind, and contributing to a sense of fulfillment.

Advisor Actions:

To meet these evolving needs, advisors should take several proactive steps:

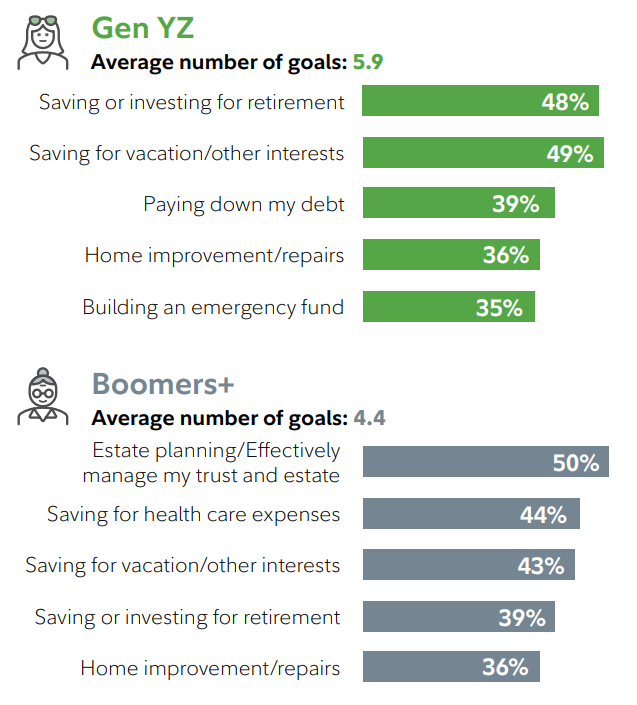

Younger generations, such as Gen YZ, tend to have more financial goals compared to older generations like Boomers+. For example, Gen YZ on average pursue 5.9 goals, while Boomers+ focus on around 4.4 goals. Each generation has distinct financial goals as well, depending on their position in the financial lifecycle.

Confidence in achieving these goals varies based on their complexity, however. Clients generally feel more assured about simpler objectives, like saving for vacations. But as the goals become more complex and multifaceted, such as achieving early financial independence or estate planning, confidence wanes.

Given these diverse and complex needs, clients increasingly seek assistance with income planning, estate planning, tax planning, and healthcare planning. In fact, a quarter of investors want these services from their advisor but aren’t currently receiving it.

Advisor Actions:

For Gen YZ and Gen X, who place a high value on open communication, the ability to “talk about anything—including their biggest fears— even if not related to money” with their advisor is the single largest contributor to higher NPS. Our study revealed in many ways that good communication leads to significantly better outcomes.

For example, engaging both partners in planning discussions is important. Research shows that NPS is 1.6 times higher when advisors reach out to both partners equally. Yet, current practice reveals that only 2 in 5 advisors do so.

Communication is again a common theme when we look at clients who are most likely to refer their advisors. Specifically, these satisfied clients are:

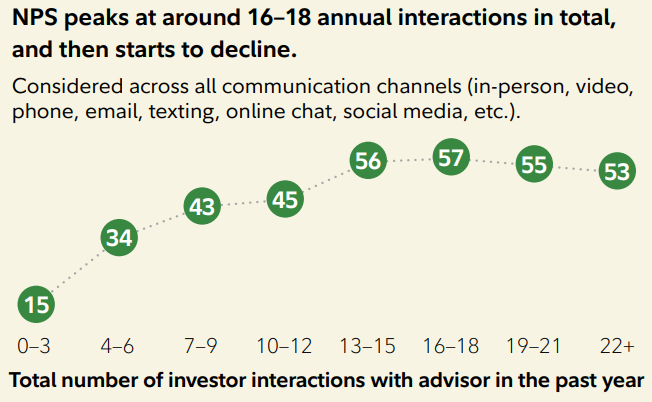

Interestingly, NPS peaks at around 16-18 total interactions annually, encompassing digital and personal touches. Beyond this point, the score starts to decline, underscoring the importance of balanced, meaningful engagement.

These findings all highlight the immense value of good communication—to understand clients better but also to more deeply engage them in open, honest dialogue about the full breadth of their needs.

Advisor Actions:

By focusing on these actions, advisors can significantly enhance client relationships, driving higher NPS and fostering more referrals.

In sum, today’s investors, especially younger generations, seek more than traditional money management—they crave guidance through life’s complexities.

Advisors can build deeper relationships by addressing varied goals like retirement planning, vacation savings, and debt reduction, as well as by facilitating meaningful conversations about all aspects of the individual’s life.

By prioritizing comprehensive, empathetic engagement, advisors can better serve their clients and significantly bolster loyalty and trust.

Take a deeper dive on this subject by reading the full 2024 Fidelity Investor Insights Study here.

You may also be interested in...

Our research continues to support the fact that clients are seeking a personalized financial planning experience.1 To fully achieve this,… Read More

Episode Summary A passionate advocate for women in the financial space, Cary Carbonaro, CFP®, MBA, Managing Wealth Advisor, Women and… Read More

In the competitive world of financial planning, staying ahead means leveraging technology to empower both you and your clients. Client… Read More

Download our latest eBook for a complete guide to asking questions that spark productive conversations.

Download Nowa new source of expert insights for financial professionals.

Get StartedTips specific to the eMoney platform can be found in

the eMoney application, under Help, eMoney Advisor Blog.