Webinar Recap: 2025 Tax Legislation Insights and eMoney Analysis

With tax policy constantly evolving, staying current on legislative updates and proactive tax planning is crucial for financial advisors aiming… Read More

Insights and best practices for successful financial planning engagement

• Celeste Revelli • February 10, 2022

Some interesting consumer trends have surfaced as part of a December 2021 survey conducted by eMoney Advisor.1 While self-directed investing continues to gain in popularity, financial professionals still have a significant role to play as many respondents indicated that they rely on them to manage some, if not all, of their investments.

This nationally representative study provided insights into what financial professionals need to know as they work to build relationships with clients in the age of DIY.

Our survey respondents demonstrated a penchant for variety when it comes to the types of investments and accounts they favor. When asked about some specific types of investments, two-thirds (65 percent) of our respondents said that they have some investment in the following:

Meanwhile, they use the following accounts:

One alarming finding is that more than one-third (35 percent) of survey respondents said they do not have an investment account or any investments. The data shows that this is true for more women (40 percent) than men (30 percent). However, cryptocurrencies are gaining popularity across the board.

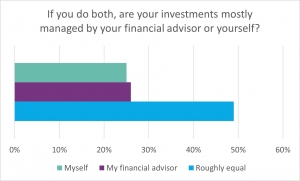

DIY investing continues to build steam as the survey revealed that over a third (34 percent) of our respondents manage all of their own investments. However, the data also shows that financial professionals are valued by many, as 38 percent stated that they rely on their financial professional to manage all their investments, and 23 percent employ a hybrid model—working with a financial professional and managing some of their own investments simultaneously.

Although many said they lean on financial professionals for advice, those within their immediate social circle and networks are also very important, with 30 percent of respondents indicating that they rely on friends and family for financial guidance. Meanwhile, 27 percent rely on their bank or credit union, a quarter (25 percent) rely on web searches like Google, and one-fifth (20 percent) rely on their employer.

Survey Results:

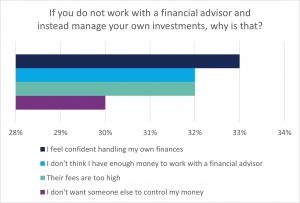

The respondents to our study who said they don’t work with a financial advisor gave many reasons for managing their own investments, but the highest-ranked motive for our group—at 33 percent—is because they feel confident doing it themselves. This is closely followed by people feeling that the fees charged by financial professionals are too high and that they don’t think they have enough money to work with a financial advisor—both coming in at 32 percent. Additionally, 30 percent said that they don’t want someone else in control of their money.

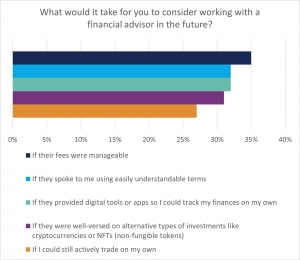

We asked the survey respondents who do not work with an advisor what would make them reconsider, and these independent investors provided some interesting insights. Accessibility is a factor in terms of fees and relatability with 35 percent saying they would consider it if fees were more manageable and 32 percent saying they would work with an advisor who provided digital tools or apps and used easily understandable terms. Consistent with the higher levels of confidence described above, 27 percent said that even if they worked with an advisor, they still want some sense of control over their finances by actively trading on their own.

This desire to feel in control of their investments could in part stem from what respondents listed as their top money concerns in 2022—some of which they can’t control—including gas prices (43 percent) and inflation (40 percent). Paying bills is also a top concern at 42 percent, with retirement savings (33 percent) and taxes (32 percent) rounding out the top five.

Survey Results:

While it was fascinating to see higher levels of confidence among survey respondents who choose to manage their own investments, this trend indicates that advisors could benefit by better communicating the value they provide. This value can be emphasized by offering greater transparency in pricing since survey results showed that clients may be skeptical about the fees they are being charged by financial professionals.

By examining your fee practices and establishing a methodology that resonates with clients, you may also find that you can offer services that will allow you to work with clients who think they don’t have enough money to engage a financial professional.

Further, by embracing technology that allows clients to track their finances on their own and expanding your service offering, you can demonstrate to clients that they are not relinquishing control over their money, but rather creating a working relationship to ensure their finances are well-managed to provide for a secure future.

DISCLAIMER: The eMoney Advisor Blog is meant as an educational and informative resource for financial professionals and individuals alike. It is not meant to be, and should not be taken as financial, legal, tax or other professional advice. Those seeking professional advice may do so by consulting with a professional advisor. eMoney Advisor will not be liable for any actions you may take based on the content of this blog.

Sources:

1 2021 eMoney Investor Trend Survey, December 2021, n=2,000.

You may also be interested in...

With tax policy constantly evolving, staying current on legislative updates and proactive tax planning is crucial for financial advisors aiming… Read More

Account aggregation works entirely behind the scenes, but it has a very real and direct impact on both the advisor… Read More

As we look back on 2024, it’s clear that the financial planning profession is evolving quickly. Our dedicated advisors and… Read More

Download our latest eBook for a complete guide to asking questions that spark productive conversations.

Download Nowa new source of expert insights for financial professionals.

Get StartedTips specific to the eMoney platform can be found in

the eMoney application, under Help, eMoney Advisor Blog.