Webinar Recap: 2025 Tax Legislation Insights and eMoney Analysis

With tax policy constantly evolving, staying current on legislative updates and proactive tax planning is crucial for financial advisors aiming… Read More

Insights and best practices for successful financial planning engagement

• Scott Nance • August 30, 2022

Impact investing is one of the biggest growth areas of the wealth management landscape. Financial advisors, if you haven’t already heard clients asking about topics related to impact investing, don’t be surprised if it’s coming soon.

In leading the impact investing program at Fidelity Charitable®, I’ve witnessed firsthand our donors’ growing interest in aligning their investments with their values to make a positive impact. As the nation’s top grantmaker, Fidelity Charitable’s mission is to grow the American tradition of philanthropy by providing programs that make charitable giving accessible, simple, and effective.

Impact investing is a $2 trillion market opportunity with tremendous growth capacity.1 Our research shows that 40 percent of investors are looking to either add more impact investments or get started with impact investing.2 And up to one-third say their advisor is the primary place they look to for support on this topic.2 That highlights the opportunity here for advisors. There is currently a gap between substantial client interest in making impact investments and implementation. Knowledgeable financial professionals can help bridge that gap.

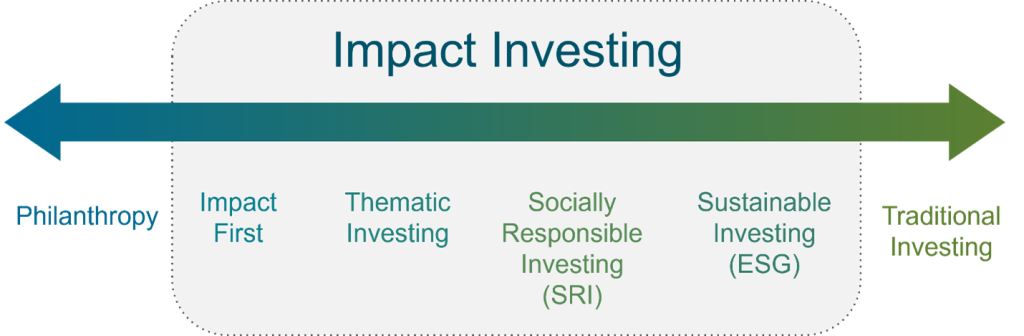

Many advisors and clients shy away from impact investing because they don’t understand what it is, exactly. It doesn’t help that different entities define impact investments in different ways. At its core, an impact investment is any investment that intentionally targets both financial return as well as measurable social or environmental impact. This umbrella term includes investments in the public markets, private equity, charitable investments, and direct investments, to name a few.

So, why should you talk about impact investing in your conversations with clients? Firstly, impact investing can provide your clients with a more deeply satisfying experience. These investment strategies aim to create a benefit that aligns with an investor’s personal values—allowing them to do well while doing good. Impact investing can open the door to more engaging conversations about your client’s passions, family, and legacy planning.

Beyond this, research has found that it can help advisors attract and retain clients. By having the impact investing conversation with clients, you are showcasing the breadth of your expertise and offering a truly holistic wealth management solution.

Consider this: 42 percent of current impact investors learned about impact investing from their financial advisor.2 And of those investors who aren’t knowledgeable about this type of investing, about a third say they would ask their advisor to learn more.2

Understanding this space can competitively position you relative to peers who don’t cover it in their practices. A recent survey of registered investment advisors showed 40 percent don’t feel prepared to offer guidance on sustainable investments as a whole.3

But you don’t have to be an expert or go it alone. Below, I dive into two case studies that help illustrate how an advisor worked closely with Fidelity Charitable® to bring the best impact investing offering to their client.

The client was an ultra-high-net-worth family with a relatively high level of investment knowledge and several family members interested in impact investing.

The patriarch of the family had been in senior financial roles at a number of companies, and one of his children worked in private equity. They wanted to establish a donor-advised fund (DAF) to honor the memory of the matriarch of the family who had passed away. They really wanted to come together as a family and make decisions about how to allocate the investments in this DAF prior to grantmaking. Having no previous exposure to impact investing, they dove in. They started looking at specific private investments and recoverable grants. And then they came together as a family and talked about what they valued.

Working with an advisor, they carved out a significant portion of the family DAF to make impact investments. Their journey was interesting. They started investing in ESG products in the public markets, but they decided that didn’t go far enough. As a result, they started exploring private investments and more sophisticated grantmaking strategies. I think that’s a good example of a family that cares about a lot of issues and sought to drive societal and environmental outcomes beyond focusing solely on financial return.

The client was a single individual who was very passionate about alleviating global poverty and helping women globally to have better economic opportunities. She was willing to take on a lot of risk with her donor-advised fund investments to maximize her funds in support of the causes she cared so deeply about.

Looking at her choices in the public markets, she wasn’t happy that some of the ESG funds she reviewed carried holdings in the biggest banks, tech companies, and healthcare firms. She wanted funds concentrated in smaller companies globally, offering products and services focused on helping people. She really wanted to get away from traditional public funds and shift to very concentrated activist funds. And in private markets, she explored small business lending, microfinance funds, and financial inclusion funds in places like Africa and Latin America.

You can see the difference between these two case study clients. Someone might say “I’m more comfortable investing with a large, established private equity firm that offers a diversified impact fund because I want the potential for high financial returns in addition to creating impact.” And another client might think, “This is an extension of my philanthropy. I’m willing to sacrifice some upside financially in exchange for driving positive social and environmental outcomes.” We have a lot of tools at our disposal for this. It really just starts with a conversation.

If you’re looking for further resources on this topic, here are a few of my favorites.

The Investment Integration Project (TIIP). They have an advisor guide that’s a great resource for starting conversations with clients and assessing where to integrate impact investing in your practice.

The National Center for Family Philanthropy. They have great impact investing resources, including webinars, case studies, and blog posts.

Toniic. This is a global action network for deeper impact investing for private asset owners. They include a directory of impact investments on their site.

Fidelity Charitable. Our recent study entitled “Using Dollars for Change: Insights into impact investing for 2022 and beyond” offers additional highlights on impact investing trends and opportunities for advisors.

Finally, if you’d like to explore more information about this promising space, watch the webinar I recently presented alongside the chief investment officer at CapShift and a financial planning expert at eMoney Advisor, The Rise of Impact Investing.

Sources:

1. “As Impact Investing Grows, So Do Expectations.” IFC, 2021. April 1. https://www.ifc.org/wps/wcm/connect/news_ext_content/ifc_external_corporate_site/news+and+events/news/insights/impact-investing-for-growth.

2. Fidelity Charitable: Using Dollars for Change, August 2021, n=1,216

3. “SEI Unveils Advisors’ Perspectives on Key Sustainability Issues.” SEI, 2021. September 21. https://www.seic.com/sei-unveils-advisors-perspectives-key-sustainability-issues.

DISCLAIMER: The eMoney Advisor Blog is meant as an educational and informative resource for financial professionals and individuals alike. It is not meant to be, and should not be taken as financial, legal, tax or other professional advice. Those seeking professional advice may do so by consulting with a professional advisor. eMoney Advisor will not be liable for any actions you may take based on the content of this blog.

The views and opinions expressed by this blog post guest are solely those of the guest and do not necessarily reflect the opinions of eMoney Advisor, LLC. eMoney Advisor is not responsible for the content, views or opinions presented by our guest, nor may eMoney Advisor be held liable for any actions taken by you based on the content, views or opinions of the guest.

You may also be interested in...

With tax policy constantly evolving, staying current on legislative updates and proactive tax planning is crucial for financial advisors aiming… Read More

Account aggregation works entirely behind the scenes, but it has a very real and direct impact on both the advisor… Read More

As we look back on 2024, it’s clear that the financial planning profession is evolving quickly. Our dedicated advisors and… Read More

Download our latest eBook for a complete guide to asking questions that spark productive conversations.

Download Nowa new source of expert insights for financial professionals.

Get StartedTips specific to the eMoney platform can be found in

the eMoney application, under Help, eMoney Advisor Blog.