Navigating Education Planning: A Roadmap for Your Client’s Journey

According to Fidelity Investments’ 2024 College Savings Indicator study, 74 percent of parents have started saving in 2024 compared to… Read More

Insights and best practices for successful financial planning engagement

• Emily Koochel • October 21, 2024

In our ongoing mission to enhance the advisor-client dynamic, our previous Evolution of Advice research laid the groundwork for understanding key client preferences for advice delivery and what tactics contributed most to client satisfaction. We focused on pinpointing where advisors and clients align and how technology can be leveraged to exceed client expectations.

Fast forward to today, and our newest study, “Planning Better Together,” builds on these insights. This research highlights the top “tech actions” that you, as a forward-thinking advisor, can implement to foster a truly collaborative client experience. We conducted a comprehensive online survey including 654 financial professionals and over 1,200 consumers, ranging from those already working with advisors to potential clients planning to engage within the year.

This study offers clear, practical steps to strengthen your client partnerships by focusing on opportunities for tighter collaboration.

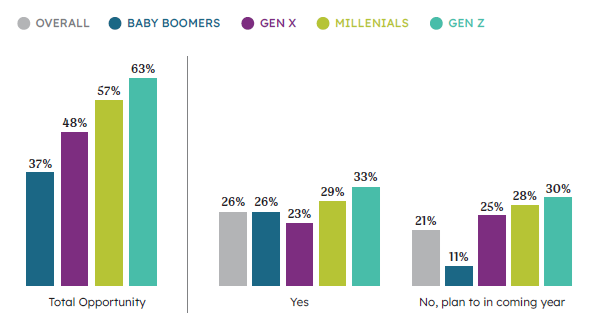

The financial advisory market is ripe with opportunity, as approximately half the market is either working with a financial professional currently or plans to work with a financial professional within the next year. This indicates a robust willingness to invest in financial advice, underlining its perceived value.

An interesting finding in our study is that the biggest market opportunity today actually lies with Millennials and Gen Z, as they most frequently reported working with an advisor or planning to in the coming year.

Collaboration plays a vital role in the planning process for these clients, especially when using comprehensive financial planning software. A significant 78 percent of consumers express a desire to be actively involved in the process of financial planning. Advisors who can effectively collaborate with clients, in the way that clients want, can ensure better outcomes and higher satisfaction. In fact, 93 percent of highly collaborative advisors have gotten referrals from their existing clients, compared to just 60 percent of less collaborative advisors.

To capitalize on the existing market opportunity, financial professionals must understand the ways in which clients want to collaborate with them, and have the technology in place to facilitate this collaboration.

Collaborative planning is all about clients and advisors working together on financial planning activities, either inside planning software or outside of it. This joint effort enhances the planning process, allowing clients to be actively involved and informed at every stage. But not every collaborative activity is the same.

Our research pinpointed five essential activities where client demand for collaboration is outpacing advisors frequency of conducting these activities.

Peace of Mind

Clients seek reassurance that they’re going to be ok. Activities like comparing plan options, stress testing, and analyzing current actions provide this assurance. This process helps them understand how their choices impact their financial stability, directly addressing concerns about unforeseen disruptions.

Confidence

Clients want to understand their financial plans thoroughly. Reviewing assumptions and estimates used in recommendations gives them insight into the mechanics of their financial future. This transparency and clear explanations help alleviate anxiety about the unknown and build confidence in their financial strategy.

Financial Security

By taking the time to review and refine recommendations, advisors show clients they are prepared for any scenario. This deepens trust and involvement in the financial journey, ensuring that clients feel secure knowing their future is safeguarded. This collaborative approach nurtures a sense of financial security, which is ultimately what clients seek—preparation for whatever life may bring.

Empower yourself and your clients by embracing these collaborative activities, making financial planning a transparent, confident, and secure experience.

Collaborative planning, where clients and advisors work closely together, offers a range of significant benefits. This partnership fosters an environment where clients are not just passive recipients but active participants in shaping their financial future.

Let’s break down the high-level outcomes of engaging in key collaborative activities.

Higher Satisfaction and Referrals

Collaborative planning demonstrably leads to higher client satisfaction. More satisfied clients are more likely to refer their advisor to others, naturally expanding the advisor’s client base. This happens because clients feel connected to the process and see the value in shared decision-making.

Greater Understanding

When clients are actively involved and understand their financial planning, they are naturally more content. This engagement translates to a deeper comprehension of their financial situation, alleviating uncertainties and enhancing their peace of mind.

More Security

Moreover, clients feel more secure about their financial future when they understand how their plan will lead them towards their goals, significantly reducing their anxiety. Also, knowing that their plans have been stress-tested and refined gives them confidence that they are well-prepared for any eventuality.

Improved Loyalty and Trust

Active collaboration combined with personalized advice strengthens client loyalty and trust. This relationship growth is key to long-term client retention and satisfaction. Clients who see their advisors as partners in their financial journey are more likely to stay the course and follow through with recommendations.

Better Client Outcomes

Clients of highly collaborative advisors enjoy better financial stability and outcomes. These advisors’ dedication to involving clients in every step ensures that plans are not only well-crafted but also robust and responsive to life’s changes.

Highly collaborative advisors—those who complete all five key activities—represent just 19 percent of the industry but see markedly better outcomes:

By embracing a collaborative approach, you not only elevate the quality of your financial planning but also significantly boost client satisfaction, security, and loyalty. This hands-on, transparent method makes financial planning accessible, empowering both you and your clients to achieve optimal results together.

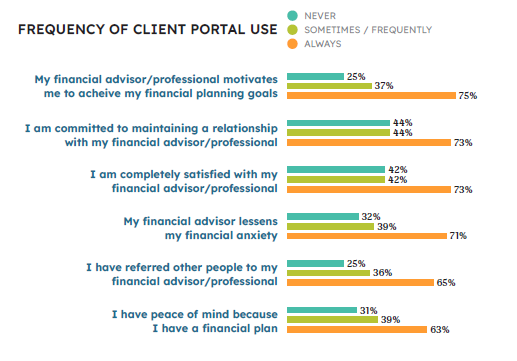

Client portals are an essential aspect of financial planning software that enable effective collaboration between advisors and clients. Using a client portal greatly improves several key outcomes:

The data shows just how significant the gap is between frequent and non-frequent portal users.

By leveraging client portals, you empower clients and streamline complex financial processes, ultimately strengthening your advisory practice and improving client outcomes.

The “Planning Better Together” study underscores the immense value of collaborative planning. By actively involving clients and leveraging robust tools like client portals, advisors can significantly enhance trust, motivation, and satisfaction.

The data is clear: collaboration not only strengthens advisor-client relationships but also leads to superior outcomes for both. Embrace these insights to empower your practice while making financial planning more transparent, engaging, and effective.

Together, you and your clients can navigate the complexities of financial planning with confidence and clarity, achieving better results and fostering lasting loyalty.

Source:

1. eMoney, “Planning Better Together” Research, June 2024

DISCLAIMER: The eMoney Advisor Blog is meant as an educational and informative resource for financial professionals and individuals alike. It is not meant to be, and should not be taken as financial, legal, tax or other professional advice. Those seeking professional advice may do so by consulting with a professional advisor. eMoney Advisor will not be liable for any actions you may take based on the content of this blog.

You may also be interested in...

According to Fidelity Investments’ 2024 College Savings Indicator study, 74 percent of parents have started saving in 2024 compared to… Read More

The onboarding process is often a financial professional’s first meaningful engagement with a new client, making it a perfect opportunity… Read More

Navigating wealth and legacy can be challenging. However, with proper preparation and communication, financial professionals can play a crucial role… Read More

Download our latest eBook for a complete guide to asking questions that spark productive conversations.

Download Nowa new source of expert insights for financial professionals.

Get StartedTips specific to the eMoney platform can be found in

the eMoney application, under Help, eMoney Advisor Blog.