Understanding the Challenges of a Client’s Scarcity Mindset

Anxiety stemming from finances has always existed and continues to be one of the top stressors for many Americans,1 particularly… Read More

Insights and best practices for successful financial planning engagement

• Brandon Heid • July 29, 2022

Goals-based and cash flow-based financial planning each provide a different approach to helping clients achieve their financial goals. Goal-based financial planning solves for the general attainment of a goal—such as funding retirement. Cash flow-based planning provides a more precise approach that takes other factors into consideration.

Each has its merits and its champions, but I believe by modeling the goals and expense funding over a client’s projected lifetime, cash flow planning truly shows how the chronological and priority funding of multiple client goals achieves the best outcomes.

By helping clients understand how asset allocation adjusts due to spending—and the tax implications of that spending—financial professionals can more accurately assess client outcomes over time.

Financial professionals who provide cash flow-based planning can help their clients gain better control of their financial situations.

For many clients, that means learning to manage their monthly cash flow better. Depending on the client’s situation this could involve working on saving a larger portion of their income while maintaining their lifestyle. For others it might require focusing on their existing cash flow problems like excessive debt, having little or no savings, or careers that have income fluctuations.

Because cash flow planning helps clients better determine where their money went and where it will go to help fund their goals, it can be used at any life stage in response to any life event.

Many financial professionals are hesitant to lead with cash flow planning because they think it is like creating a budget for their clients. And while a budget may set clients up to begin achieving their financial goals, understanding how cash moves into and out of their accounts will determine how successful they are in achieving those goals.

The process of preparing a cash flow-based financial plan begins with information gathering—compiling historical financial information, identifying income sources and spending patterns, preparing prospective cash flow scenarios, setting up a monitoring system, and comparing the outcomes to actual cash flow. Creating such a plan helps clients determine their current lifestyle and with an eye to achieving future goals.

Additionally, leading with cash-flow management is a great way to begin a new client relationship. It provides a way for clients to take immediate action towards improving their financial situation. For clients that are new to financial planning, it’s a means to take something complex and make it simple and easy to understand.

Making cash flow a part of a client’s financial plan and watching it closely can also keep mistakes from happening. In the short term, a client’s cash flow is usually pretty set—they have a specific amount to spend every month and if it’s not considered as part of their financial plan, overspending can quickly derail other parts of the plan.

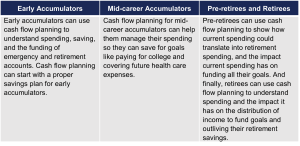

There are many factors in a client’s financial life that may indicate the need for cash flow planning. Clients who are having difficulty saving the amounts required to fund their goals are ideal candidates. A client’s life stage also provides insights into when they may benefit from cash flow planning.

In the financial industry, life stage is often associated with age.

Cash flow planning can be valuable at any life stage.

But in addition to the ways cash flow-based financial planning supports your clients during the stages of their lives, there are also events that could happen at any time in a client’s life that benefit from the use of cash flow planning.

Because these life events aren’t tied to age, financial planners must ensure there is flexibility in the client’s plan to handle the unexpected cash inflows and outflows that could happen throughout their lifetime.

The intricacy of a cash flow plan will be based on the needs of each individual client relationship.

There may be clients who will need a comprehensive plan that includes very specific cash inflow and outflow details. Others may be fine with a simplified cash flow plan that only includes the level of detail to ensure that amounts needed to fund financial goals are invested.

Financial professionals can make that determination based on each client’s needs by having open, honest conversations about money management.

A simplified approach may be fine where spending and savings goals are set and the client is motivated to make necessary changes. On the other hand, a comprehensive approach may be more suitable when the client needs to identify and control spending habits, has details available for monitoring, or has complex or irregular cash flow patterns.

Using either approach, the financial planner can project a single period or multiple periods depending on anticipated future events and other circumstances impacting the client’s life. Continuous monitoring will ensure that when unanticipated changes occur, the plan can be adjusted accordingly.

There’s a preconceived notion among financial planners that cash flow planning is a difficult and time-consuming process. But it comes down to understanding its basic elements and determining the deliverables that make the most sense for your client.

Simplifying the delivery of a cash flow plan can be accomplished by employing the right technology tools. These tools can range from detailed cash flow reports showing annual simulations for inflows, outflows, and total portfolio assets, to interactive tools that allow financial planners to model recommendations in real-time during client review meetings.

It’s also important to look for technology that supports the process by providing account aggregation to incorporate real-time client account balances to improve cash flow projections as well as an interactive client portal so the planner and client can easily share pertinent information with each other.

Successfully positioning the value of cash flow planning can be a real differentiator when financial professionals are looking for ways to engage new clients and grow their business.

Clients are looking for personalization in the financial planning relationship, so the more services you offer, the greater your ability to set yourself apart. Offering cash flow planning is one such service that will do just that.

Creating a unique planning experience for each of your clients may seem like a monumental task, but it becomes easier when you make the most of technology to gain efficiency and build deeper relationships.

For more on ways to engage clients in depth, I recently co-hosted a webinar, 11 Ways to Engage with Purpose. Watch the on-demand version to learn everything you need to know about engaging clients in the planning process at scale.

DISCLAIMER: The eMoney Advisor Blog is meant as an educational and informative resource for financial professionals and individuals alike. It is not meant to be, and should not be taken as financial, legal, tax or other professional advice. Those seeking professional advice may do so by consulting with a professional advisor. eMoney Advisor will not be liable for any actions you may take based on the content of this blog.

You may also be interested in...

Anxiety stemming from finances has always existed and continues to be one of the top stressors for many Americans,1 particularly… Read More

Financial planning is most effective when it accounts for the realities of change, uncertainty, and transition. Markets shift, careers evolve,… Read More

We all know that helping clients manage their wealth doesn’t stop at accumulation. One of the most rewarding parts of… Read More

Download this eBook now and learn how AI is expected to impact the industry.

Download Nowa new source of expert insights for financial professionals.

Get StartedTips specific to the eMoney platform can be found in

the eMoney application, under Help, eMoney Advisor Blog.