The Future of Financial Planning: From Numbers to Mindsets

The world of financial planning is undergoing a series of profound transformations.1 Gone are the days when financial advisors were… Read More

Insights and best practices for successful financial planning engagement

• Chris Mauriello • September 30, 2022

The start of every financial planning relationship inevitably involves some type of financial data gathering and organization. This process is a perennial pain point for financial professionals. It’s often complex, slow, and full of manual data entry.

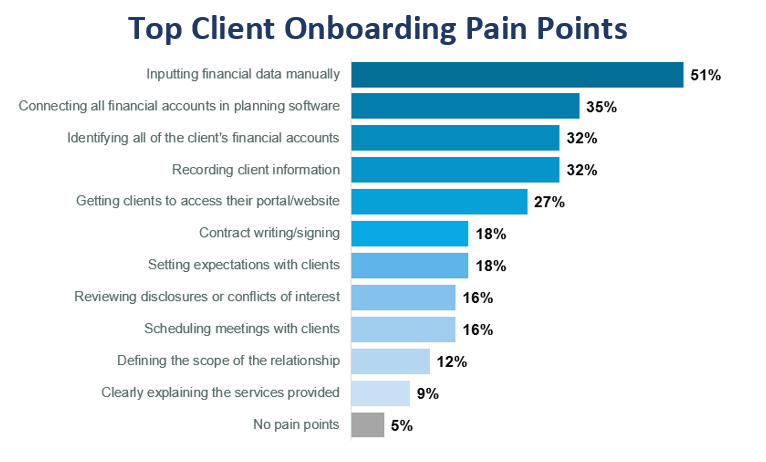

In fact, when looking at the most common client onboarding pain points, dealing with clients’ financial data accounts for four of the top five pain points.1

With the right workflows in place, financial professionals can streamline fact-finding and get clients more engaged with their plan leading to tremendous efficiencies and greater planning success down the road.

Here are two financial fact-finding workflows to implement in your practice.

As a financial professional, you more than likely have a number of clients you could classify as “do it for me” clients. These are individuals who seek your help because they want you to do the majority of the planning and maintenance work for them.

These clients are typically HENRY or HNW and expect a comprehensive, white-glove type of holistic planning service. They want their financial professional to take care of all their finances—and everything related to their finances—so they can focus on more important things in their life.

Fact-finding for these clients will focus on in-person meetings and clear guidance on what is needed from them.

You can start the financial fact-finding process by having a ready-made welcome kit for all new clients, ideally with some level of personalization for each new client. In this welcome kit, you can include:

“Do it for me” clients may not upload documents to their portal themselves, but it’s important to be very clear about which types of documents you’ll need from them and how these documents are required to get the process started. This list of documents is something you can create ahead of time based on existing clients’ financial situations.

To offer a comprehensive, white-glove service for “do it for me” clients, it’s best to set up an introductory meeting in person. This meeting is essential for fact-finding and when executed correctly, can accomplish the majority of the fact-finding. There are several things that can happen during this meeting.

Whether or not clients have set up their portal on their own, one of the very first things you should do is walk them through everything their portal entails. This process can include a few key points:

Even for clients who want everything done for them, getting them into their client portal can ensure they’ll help keep their financial information up to date.

Talking about data privacy and security will be extremely important for “do it for me” clients. They may have less exposure to tools like client portals and heightened concern regarding the protection of their sensitive information.

It’s important to have this discussion when both individuals in a relationship are present. Explaining the ways in which you’ll safeguard their data is an essential component of getting buy-in to the client portal and the planning process in general.

Discussing privacy and security will further the trust and transparency you’ve established when introducing the client portal.

If clients bring in account statements and other financial documents, it’s a good idea to have an assistant or other support staff collect those documents and start scanning them during the meeting. By the end, you’ll be able to show the clients how all the information they provided is in one secure place online.

Relying on support staff is a great way to offload some of the manual, time-intensive parts of fact-finding and data gathering. It frees you up to focus on the important conversation you need to have with clients to uncover as much as you possibly can in that first meeting.

After you’ve talked about the client portal, along with privacy and security, it’s best to then start talking about the client’s goals and values. It may be tempting to go through a dry financial fact-finding questionnaire, but starting the conversation about goals and values will offer a much better experience.

By asking clients about themselves, you’ll start to introduce them to your holistic process, to planning itself, and to the fact that you care about them as individuals. You’ll set the foundation of your relationship this way, showing them that your work with them will not simply be transactional.

Of course, as you’re talking to them, you or a staff member can be filling out a preliminary fact finder in the background because financial information will inevitably emerge. But the information you uncover while talking about goals and values will ultimately guide the entire planning process.

A lot of ground can be covered in an initial, introductory meeting. For comprehensive planning, however, it’s likely that another meeting or series of meetings may be needed before the plan is presented. If you don’t have time to collect all the pertinent preliminary facts in the initial meeting, you can drill down into these details as you determine what information you have and what data you need.

Getting clients hooked on their client portal is a great way to spark productive conversations moving forward where plan information can be updated as necessary.

Unlike “do it for me” clients, DIY clients are digital savvy, self-starters that take great interest in their financial situation. They thrive on a sense of control of their finances, and while some may want comprehensive planning services, many will prefer episodic advice as their financial situations mature.

For DIY clients, the financial fact-finding process can be greatly streamlined through technology and by encouraging greater input from the client.

Just as in the previous workflow, you’ll still want to send clients a welcome kit. This could include:

With DIY clients, you can expect them to take on this responsibility themselves, if not before your first meeting, then afterward once you have explained the value of the client portal.

With DIY clients, you can set up your initial meeting over Zoom to streamline the process. If they haven’t already uploaded their important documents to their portal, walk them through the process. You can even share your screen to demonstrate how it’s done.

You’ll want to have a similar conversation with DIY clients about the value of the client portal and the importance of setting up all the connections. Once they understand why this is important, you can trust that they’ll do the work of getting their important documents uploaded and connecting all their financial accounts.

Once you’ve properly demonstrated the value and capabilities of their client portal, start talking to them about their goals and values. They may have sought you out for one specific question, such as how much home they can afford or help with spending and budgeting, in which case you should be able to get to the root of what they’re hoping to achieve rather quickly. For clients that want a more comprehensive, ongoing service, be sure to have the values conversation at this point to demonstrate your commitment to their well-being and align their plan with what they want to achieve in life.

If one meeting isn’t enough to capture all the information you need for a DIY client, they should be able to give you everything else you need digitally. For example, if they need to upload a few account statements after the initial meeting, assign them this task through their client portal with the expectation that it must be completed before the plan can be completed.

If you have a preliminary fact-finding worksheet, you could even send them a partially completed worksheet and ask that they complete it. Should they have any questions about their financial situation, you could also have support staff available to answer a quick call or email to help them through the process.

DIY clients will likely be comfortable finding and sharing this type of information online, which can greatly simplify the process for you and your team.

Financial fact-finding is a common pain point for planners. It accounts for many of the top difficulties in new client onboarding.

Whether your clients want a comprehensive, white-glove planning service or a single planning meeting, having an established fact-finding workflow can create major efficiencies and help scale financial planning in your firm.

Continue learning on this subject by reading about digitizing your onboarding process and get three highly efficient onboarding workflows for your firm.

DISCLAIMER: The eMoney Advisor Blog is meant as an educational and informative resource for financial professionals and individuals alike. It is not meant to be, and should not be taken as financial, legal, tax or other professional advice. Those seeking professional advice may do so by consulting with a professional advisor. eMoney Advisor will not be liable for any actions you may take based on the content of this blog.

Sources:

1. eMoney Leading with Planning Research, May 2022, Advisors n=360

You may also be interested in...

The world of financial planning is undergoing a series of profound transformations.1 Gone are the days when financial advisors were… Read More

In the world of financial planning, there is no shortage of rules, principles, and general best practice advice designed to… Read More

Trust is a fragile component of any professional relationship, but in the financial planning industry, it’s especially precarious. After all,… Read More

Download our latest eBook for a complete guide to asking questions that spark productive conversations.

Download Nowa new source of expert insights for financial professionals.

Get StartedTips specific to the eMoney platform can be found in

the eMoney application, under Help, eMoney Advisor Blog.