Shifting from a Sales-driven to Planning-focused Mindset

If your institution’s advisors have traditionally focused on sales rather than planning, you might be facing a common challenge: resistance… Read More

Insights and best practices for successful financial planning engagement

• Joe Buhrmann • May 10, 2022

Many financial professionals aspire to provide a more holistic client experience with financial planning. According to the latest from Cerulli Associates1, by 2023 82 percent of advisors’ clients will receive targeted or comprehensive financial planning services.

But the reality is, a financial professional’s time is often constrained across the demands of running the business. About half of their day is spent on the administration of their practice, investment management, and professional development.1 And the remaining 50 percent is spread amongst the client-facing side of wealth management—including client meetings, client service, prospecting, and planning.1 Unless there is an ability to outsource a competing service area, most financial professionals only have so much time to dedicate to planning.

However, it is worth the time because the financial plan can serve as the touchstone to create new revenue streams to an asset-based practice. This is especially true for financial professionals that use financial planning technology to scale their efforts.

Small adjustments to your book of business can create big opportunities for financial planning revenue growth and impact assets under management (AUM).

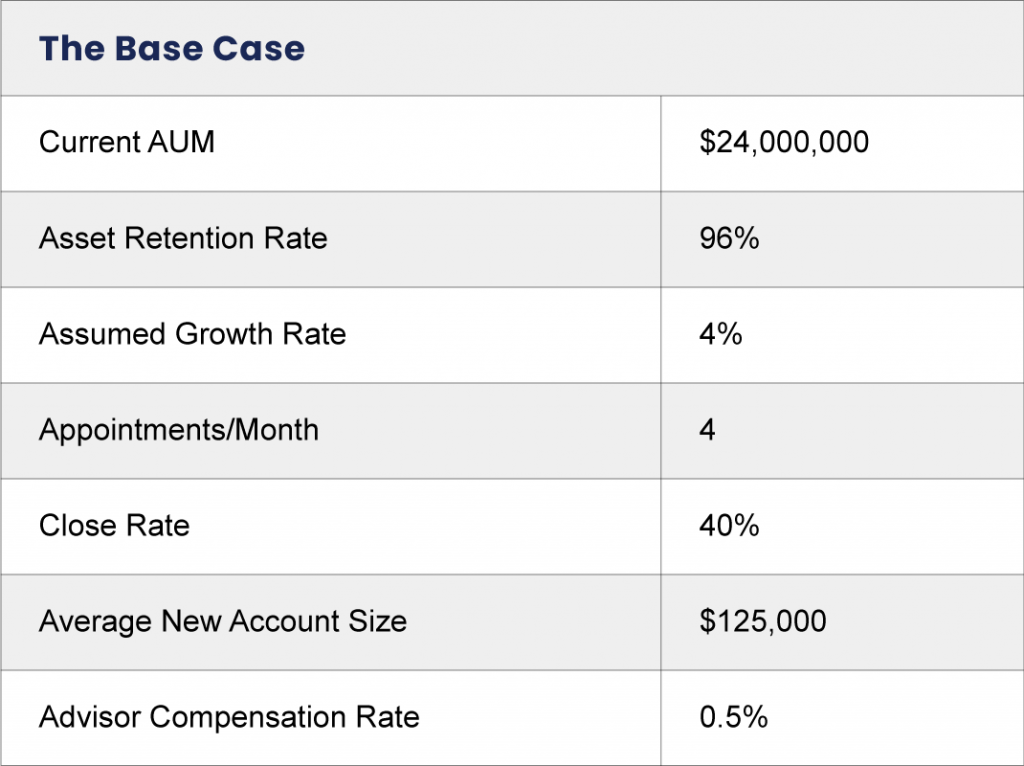

To help advisors see that increasing revenue from planning is possible, I have created a hypothetical, or base case scenario, illustrative of the components that make up a financial professional’s revenue. This is not an actual representation of any single financial advisor or practice, but it is intended to be representative of firms using an asset-based fee model.

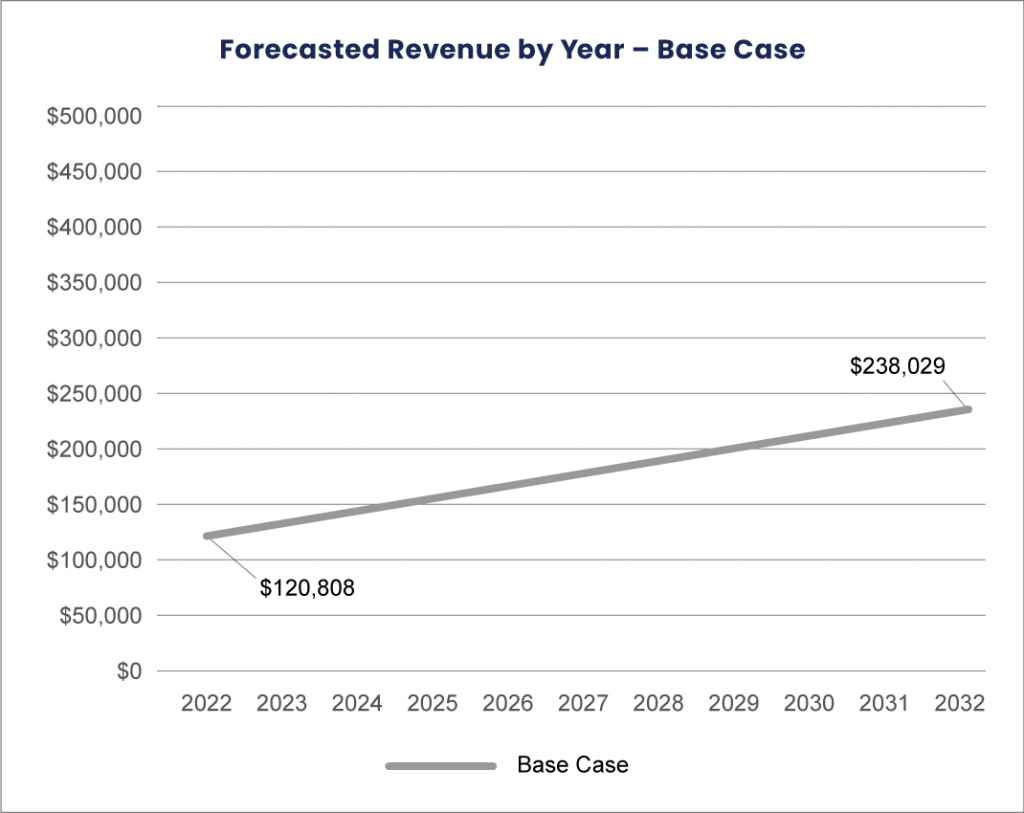

With those assumptions and inputs, your base case of revenue beginning at $120,808 is projected to grow to $238,029 as your AUM grows over the course of 10 years.

Just as many of you do scenario planning with clients about how potential decisions will impact their money over a given period, let’s take a look at how small adjustments to increase planning could impact your variables on revenue.

Let’s say you’ve been working hard to effectively communicate your value as a financial professional. You’ve been able to successfully talk about your services—how you do them and why you do them—and prospects are engaging.

Perhaps clients are transferring additional money to you, or they decided that additional life insurance as scoped in the plan is the best option for them. A financial plan is a solid vehicle to help you build trust and solidify your recommendations, resulting in better capture rates.

Planning technology is especially useful here to unlock possibilities with current clients. It can also give prospective clients a more tangible glimpse into what you can deliver to them through a demonstration of a similar sample client.

These efforts lead to an increase in your close rate from 40 percent to 55 percent. Now in our hypothetical case, an enhancement to your close rate inches you a bit closer to growing revenue to nearly $285,000 over 10 years.

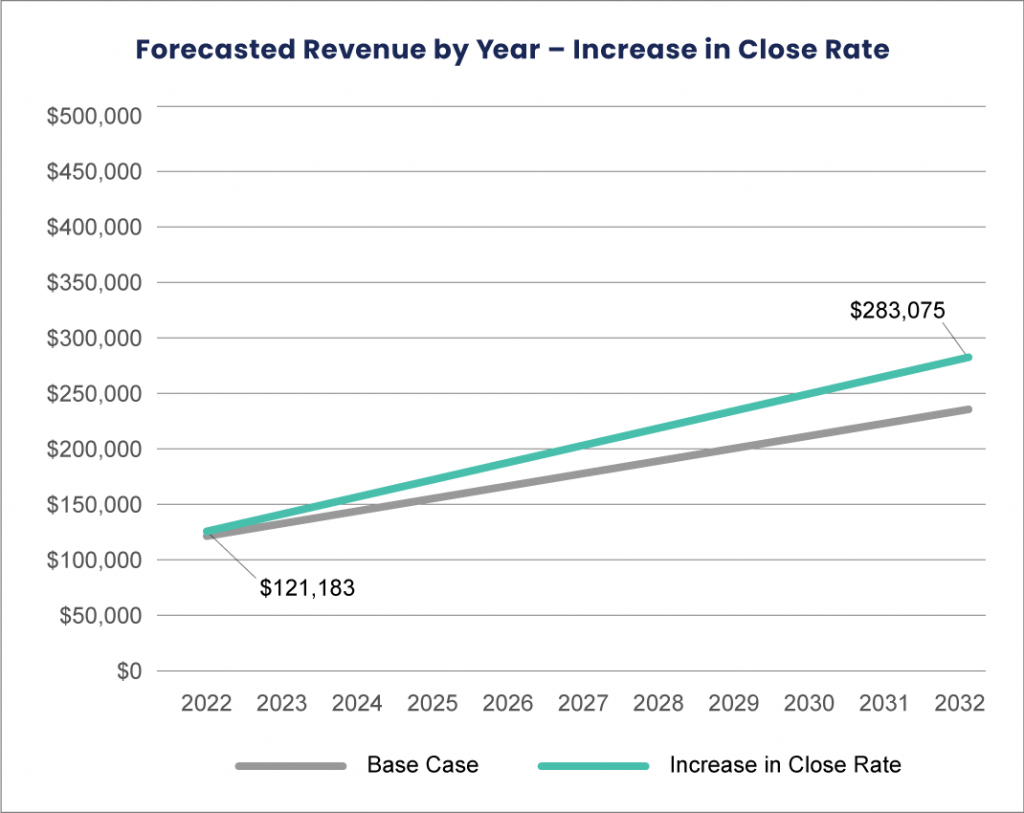

With confidence growing in your pitch, you’ve enhanced in your close rate and achieved better efficiency in your time to prepare for these client interactions. To that end, maybe you could make one more phone call or do one more additional appointment per month—what does that do?

Once again, using planning software or a responsive client database that you can filter will be extremely helpful in making sure your efforts are targeted. Data analytics on your book of business can provide the depth and breadth of planning insight needed across client relationships to uncover opportunities.

Taking that additional client meeting or phone call to average at least five interactions per month, up from four will now put projected revenue over $300,000, growing nearly $100,000 from the base case.

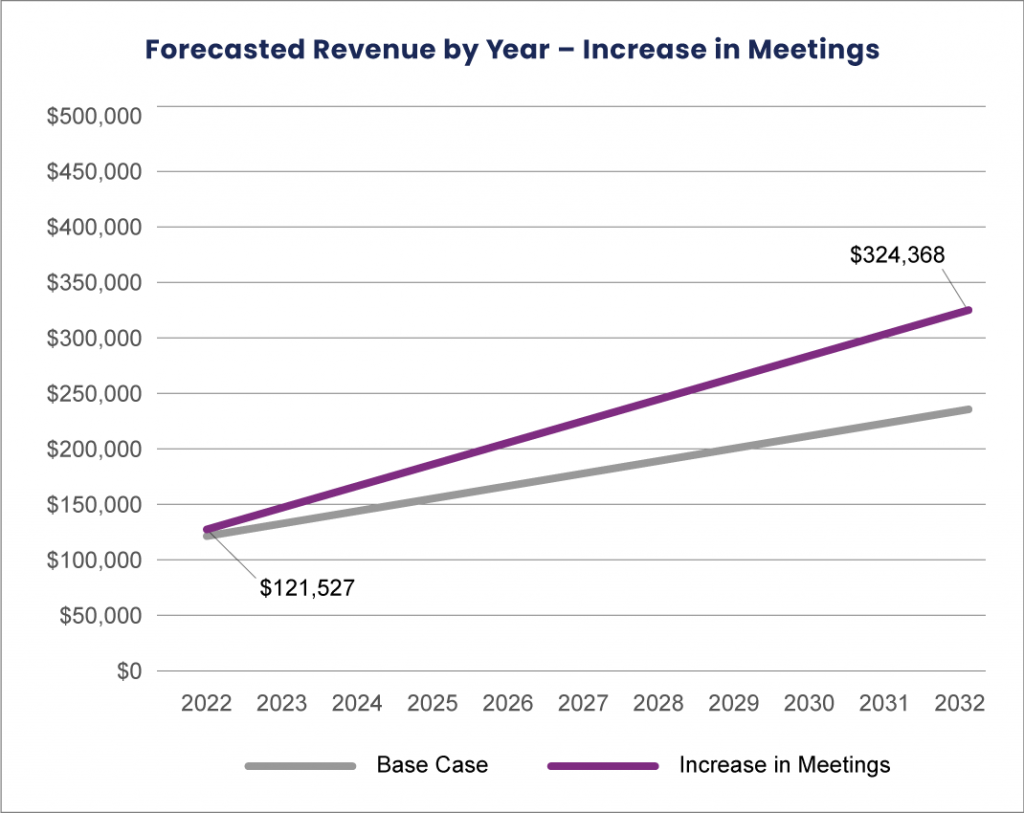

As you are finding efficiencies in your business and perhaps building out more expertise in a given area of your business—education, estate, tax planning, or other niche topic—you are uncovering more of the total picture. Financial planning helps uncover all the needs and, subsequently, all client assets too.

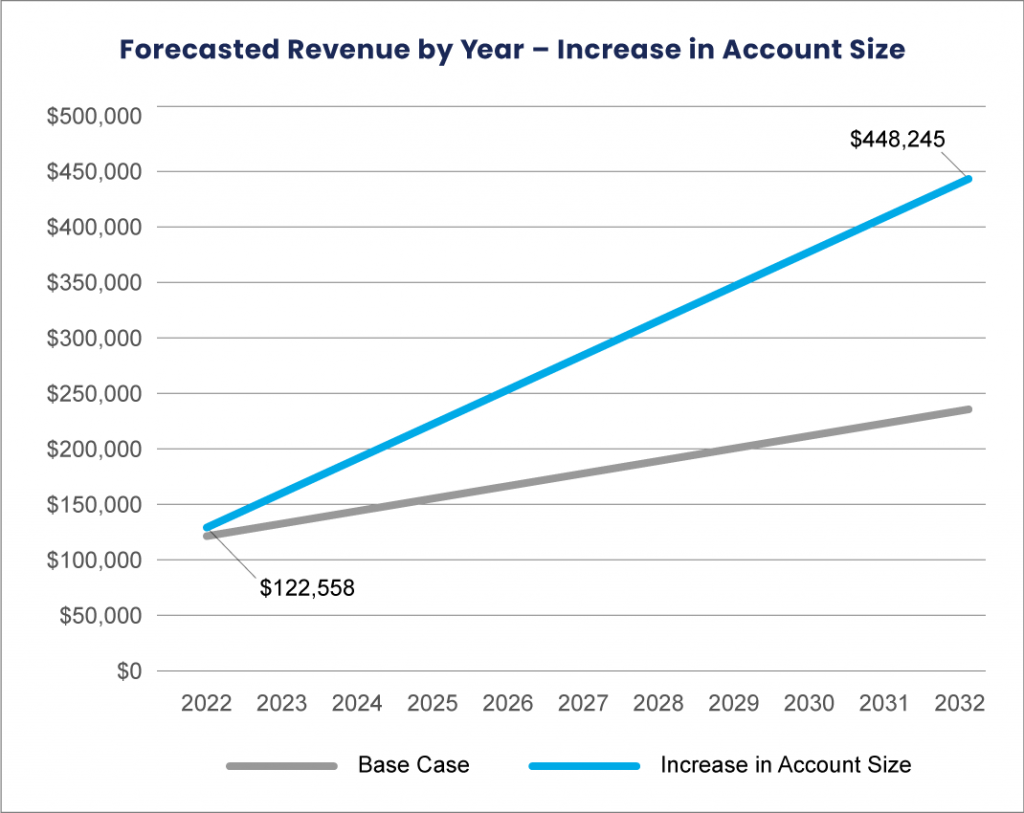

Rather than just completing a 401(k) rollover, by taking a holistic approach, additional assets or retirement accounts can be uncovered, resulting in additional capture of assets. Because you are building a deeper planning relationship with clients, your average account size has now grown from $125,000 to $200,000.

Once again, by changing this input in our base case, you can see the significant effect it can on your potential revenue.

Whenever you want to take the next step in growing your business, it’s always good to get a baseline assessment of what you are doing presently.

As shown in this example, one additional client meeting, or a shift in your average target account size, makes a difference. Given time, taking small steps will make significant variations to your potential revenue and provide growth to your business as you offer more comprehensive financial advice.

For additional information on popular financial planning fee structures, making the most of your planning expertise, and how other financial advisors are charging for financial planning, learn more in our eBook Shifting Your Compensation Model.

Source:

1 The Cerulli Report—U.S. Advisor Metrics 2021: Client Acquisition in the Digital Age, Cerulli Associates, January 2022.

DISCLAIMER: The eMoney Advisor Blog is meant as an educational and informative resource for financial professionals and individuals alike. It is not meant to be, and should not be taken as financial, legal, tax or other professional advice. Those seeking professional advice may do so by consulting with a professional advisor. eMoney Advisor will not be liable for any actions you may take based on the content of this blog.

You may also be interested in...

If your institution’s advisors have traditionally focused on sales rather than planning, you might be facing a common challenge: resistance… Read More

A financial planner’s time is precious, and chances are, you sometimes feel like you’re not squeezing all the juice out… Read More

If you’ve dipped your toes into the concept of transparency in financial planning, you probably have a solid grasp on… Read More

Download this eBook now and learn how AI is expected to impact the industry.

Download Nowa new source of expert insights for financial professionals.

Get StartedTips specific to the eMoney platform can be found in

the eMoney application, under Help, eMoney Advisor Blog.