Overcoming the Inertia of Legacy Platforms

Firms are striving to equip advisors with the right tech and data insights to expand planning relationships with new and… Read More

Insights and best practices for successful financial planning engagement

• Emily Koochel • April 18, 2024

Feelings of financial insecurity have surged to an all-time high among Americans, with one-third (33 percent) reporting that they do not feel financially secure, according to Northwestern Mutual’s 2024 Planning & Progress survey1. This has led to heightened feelings of financial anxiety, leaving many individuals worried about their financial future.

Financial professionals are well-positioned to address this issue. Our 2023 Beyond the Plan research shows that financial advisors who address a client’s financial anxiety through incorporating actions based on financial psychology (finpsych) see greater client satisfaction. Furthermore, tech-forward advisors—those who embrace technology and believe it’s an important part of the client experience—see remarkably better outcomes than tech-averse advisors in multiple categories, including lessened client financial anxiety and increased client satisfaction, trust, and loyalty.2

One of the most prevalent and enduring types of stress is financial stress. When it comes to managing our money, we often encounter stressors on a regular basis—such as unexpected car repairs, childcare expenses, and more. Although worrying about not having enough money to cover unexpected expenses can cause financial uneasiness, financial anxiety runs deeper. It can involve obsessing over where every dollar is spent or imagining situations where you lose all of your money.

Despite the growth in wealth and income for U.S. households in 2022 and 2023, the Federal Reserve’s Report on Economic Well-being of U.S. Households revealed a concerning trend: the percentage of adults who reported being at least financially stable in 2022 decreased by 5 percent compared to 2021, standing at 73 percent. Additionally, in February 2023, a Gallup survey found that 50 percent of U.S. adults felt they were financially worse off than the previous year, while only 35 percent believed they were better off. Building the case for why helping people ‘feel’ financially well is just as important, if not more so, than showing them they are financially well.

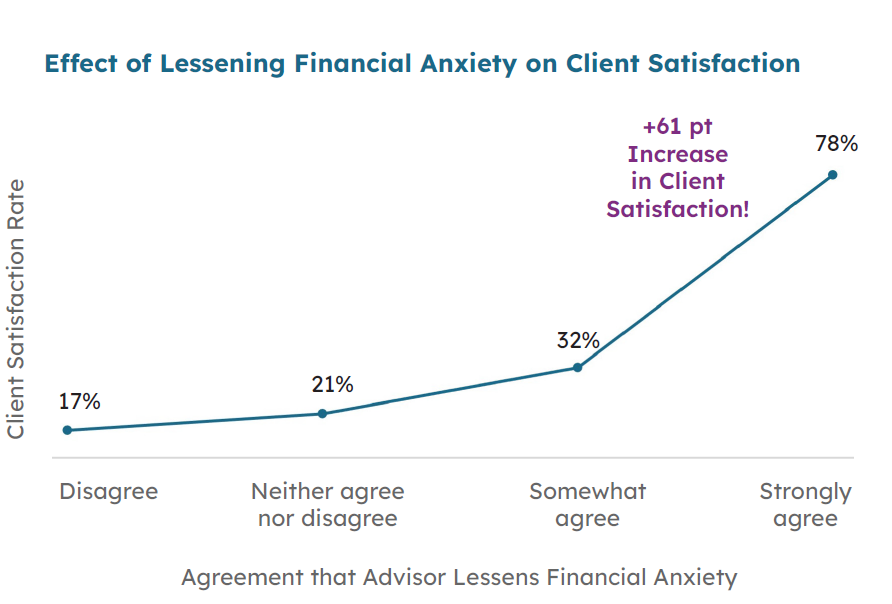

Our research demonstrates that client satisfaction increases significantly—by 61 points—when clients feel their advisor has helped to reduce their financial anxiety.

While advisors are certainly not therapists, adopting best practices in financial psychology can help reduce clients’ financial stress, boosting their confidence, financial success, and satisfaction with your services.

Our research identifies the top five most effective finpsych actions in reducing financial anxiety:

In essence, advisors who practice active listening, dig into client values, address financial concerns, and communicate effectively can mitigate financial anxiety and significantly improve client satisfaction.

To learn more about implementing these five finpsych actions, take a deeper dive into our eBook The New Advisor Value Proposition: How Combining Technology and Financial Psychology Transforms Client Outcomes.

When financial anxiety decreases, trust, loyalty, and overall client satisfaction increase. Technology, specifically a client portal, is a helpful tool to accomplish this.

This is because the use of a client portal helps advisors meet key client priorities. Clients report that a portal increases their collaboration with their advisor, deepens their knowledge of personal finance, and ultimately strengthens their relationship with their advisor through better communication.

Portals meet these client priorities by:

In fact, frequent client portal use kickstarts a whole technology benefit hierarchy.

Through these features, the client portal can help lessen clients’ financial anxiety, which fosters trust in their relationship with their advisor. That trust breeds loyalty, which ultimately creates overall satisfaction.

In this way, client portal use is strongly associated with far superior client outcomes in the financial planning process. The key to realizing these outcomes is getting clients to use their portal frequently.

To maximize the benefits of a client portal, encourage your clients to adopt it and become frequent users. It can take some upfront work to get your clients interested and coming back time and again.

Here is a five-step workflow to encourage portal adoption among your clients.

As clients become more accustomed to their portal, introduce additional features to further ease their journey toward their financial goals. By doing so, you not only showcase the portal’s capabilities but also emphasize your role as a trusted advisor.

The advisors who achieve the best client outcomes are those who can integrate financial psychology techniques and a commitment to technology within their practice. Client portals are optimal for implementing this dual approach, having been proven to enhance client satisfaction, loyalty, and referrals. In fact, 56 percent of frequent portal users refer their advisor twice as often as non-users and 70 percent feel strongly committed to their advisor relationship.1

Employing a strategy that combines financial technology with psychological insights not only improves your bottom line but also enriches the client engagement and planning experience.

To learn how to do this at your firm, watch our webinar, where I’m joined by my colleague Chris Mauriello, Senior Financial Planning Practice Management Consultant at eMoney, to walk you through how to use a client portal in a way that aligns with the finpsych best practices laid out in this post.

Sources:

1. “Planning & Progress Study 2024.” Northwestern Mutual, 2024. March 11. https://news.northwesternmutual.com/planning-and-progress-study-2024.

2. eMoney, “Beyond the Plan” Research, July 2023

You may also be interested in...

Firms are striving to equip advisors with the right tech and data insights to expand planning relationships with new and… Read More

In many ways, the financial industry stands at a crossroads. One of the key reasons is the accelerated pace of… Read More

Financial planning in today’s world increasingly relies on technology and using digital tools to enhance the role of a financial… Read More

Download this eBook now and learn how AI is expected to impact the industry.

Download Nowa new source of expert insights for financial professionals.

Get StartedTips specific to the eMoney platform can be found in

the eMoney application, under Help, eMoney Advisor Blog.