The Future of Financial Planning: From Numbers to Mindsets

The world of financial planning is undergoing a series of profound transformations.1 Gone are the days when financial advisors were… Read More

Insights and best practices for successful financial planning engagement

• Sasha Grabenstetter • August 10, 2022

Gathering client data, creating a holistic plan, making recommendations—you think you’ve done everything necessary to set your clients up for success. But how do you motivate them to take action towards their own financial goals?

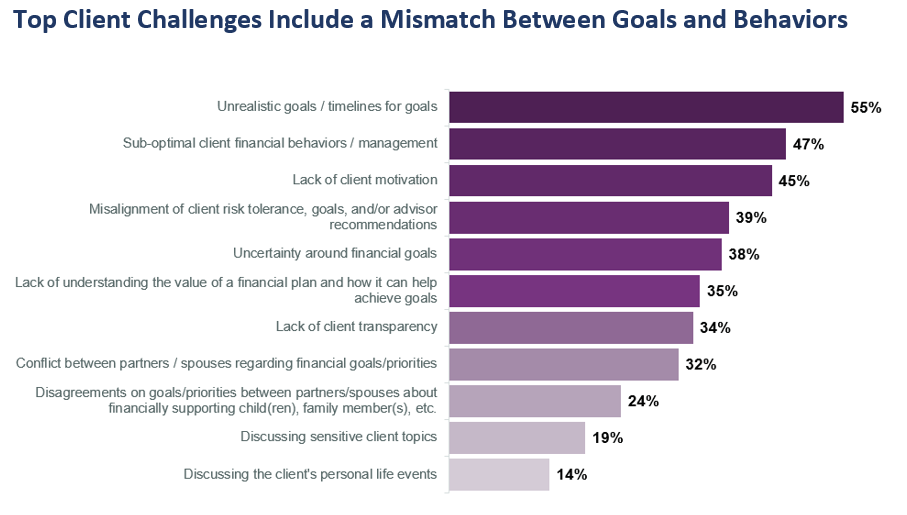

An understanding of the motivations behind human financial behavior is a great place to start. According to our research,1 a majority of clients struggle with a mismatch between their goals and their behaviors. And 45 percent of clients—almost half—struggle with a lack of motivation.

To help motivate your clients to take action, you can use techniques like motivational interviewing to address your clients’ goals, understand the reasons behind their financial behaviors and habits, and enable them to make impactful changes.

Creating trust in the client relationship is the first step to getting to the core of client issues, motivations, and expectations. To use motivational interviewing, clients first have to trust you.

Financial professionals should understand that clients are experts about their own lives and have the resources within themselves to create change. Offering an open, non-judgmental environment helps your clients feel comfortable sharing which creates a trusting partnership that opens the door for collaboration.

Your clients may agree to the goals you have set together, but their actions may not align. Unaddressed spending patterns and unhelpful financial behaviors can easily get in the way of their progress and the success of their plan.

Getting to the root of these problems is critical to enabling change, but it can be difficult to identify and talk about sensitive money topics.

Once clients feel comfortable collaborating with you, simple motivational interviewing techniques can get them to start taking stock of their financial situation. Motivational interviewing includes guiding your client in conversation and empowering them to come to their own conclusions and meaning.

It involves active listening, treating the client like an equal partner, and staying away from offering unsolicited advice. Motivational interviewing is especially useful to help clients understand their own situation, behaviors, and options when they feel ambivalent about change, a lack of confidence or understanding to act on change, or low motivation to take action.2

These techniques can create an open dialogue and help you dig deeper into what’s driving your clients’ spending habits and behaviors. This requires asking the right questions and listening to what the client is really saying.

Some common motivational interviewing techniques include:

Helping your clients understand the reasons behind their own financial behaviors will help them come to their own conclusions and solutions, empowering them to make changes and act on these solutions.

As a financial advisor, you can guide your clients to realign their ways of thinking, and collaborate and negotiate on new, more realistic financial goals.

Keeping your clients engaged along their journey is critically important for the success of the plan. But keep in mind every client has their own reasons for wanting to reach their financial goals.

Use what you learn about your clients’ financial behaviors and motivations to continue to guide them to their own conclusions, help them understand your recommendations, and stay engaged throughout the process.

Financial psychology offers a number of lessons for planners to connect with clients on a deeper level and improve outcomes. To continue learning on this topic, check out our eBook Tapping into the Emotional Side of Planning.

Sources:

1. eMoney Leading with Planning Research, May 2022, Advisors n=360

2. Miller, W.R. & Rollnick, S. (2013) Motivational Interviewing: Helping people to change (3rd Edition). Guilford Press.

DISCLAIMER: The eMoney Advisor Blog is meant as an educational and informative resource for financial professionals and individuals alike. It is not meant to be, and should not be taken as financial, legal, tax or other professional advice. Those seeking professional advice may do so by consulting with a professional advisor. eMoney Advisor will not be liable for any actions you may take based on the content of this blog.

You may also be interested in...

The world of financial planning is undergoing a series of profound transformations.1 Gone are the days when financial advisors were… Read More

If you’ve ever struggled to help your clients embrace better money habits, there are steps you can take to assist… Read More

Trust is a fragile component of any professional relationship, but in the financial planning industry, it’s especially precarious. After all,… Read More

Download our latest eBook for a complete guide to asking questions that spark productive conversations.

Download Nowa new source of expert insights for financial professionals.

Get StartedTips specific to the eMoney platform can be found in

the eMoney application, under Help, eMoney Advisor Blog.