Shifting from a Sales-driven to Planning-focused Mindset

If your institution’s advisors have traditionally focused on sales rather than planning, you might be facing a common challenge: resistance… Read More

Insights and best practices for successful financial planning engagement

• Brandon Heid • December 12, 2022

Broadening the reach of your financial planning services is good for the health of your business, helps your advisors become more successful, and increases the likelihood that they continue to build their careers with your firm.

However, scaling your advisors’ ability to provide those plans requires the right type of support, which will be unique to your firm’s size, goals, and focus.

Our recent research1 uncovered the top ways home offices are enabling advisors to do more planning and revealed that advisors who prioritize planning are seeing superior business and client outcomes.

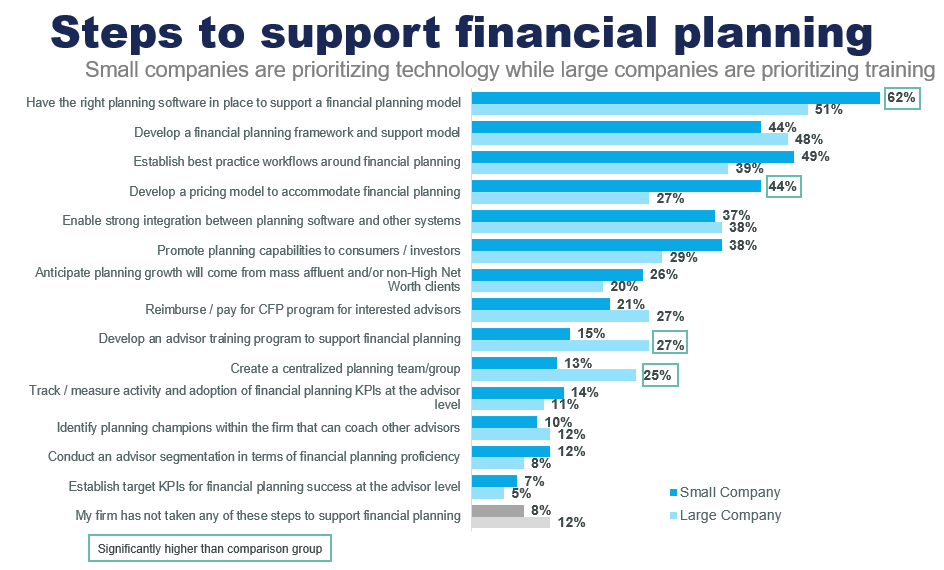

When asked what steps are or will be taken to support financial planning, the majority of firms say they prioritize implementing the right planning software to support a financial planning model. This is true among firms large and small, which shows the importance of having a strong foundation in technology for effective planning.1

Firms are also focused on developing a financial planning framework and support model, as well as establishing best practice workflows around financial planning. 1 Both of these tactics can encourage efficient, repeatable planning processes that help create a consistent planning experience across the firm.

The most frequently cited steps from this research reveal that firms clearly understand how technology and the right operational models and processes can facilitate financial planning at scale.

Putting the components in place that can help advisors avoid the distractions and disruptions associated with the more manual work of financial planning helps them prioritize and stay focused on building deeper relationships with clients.

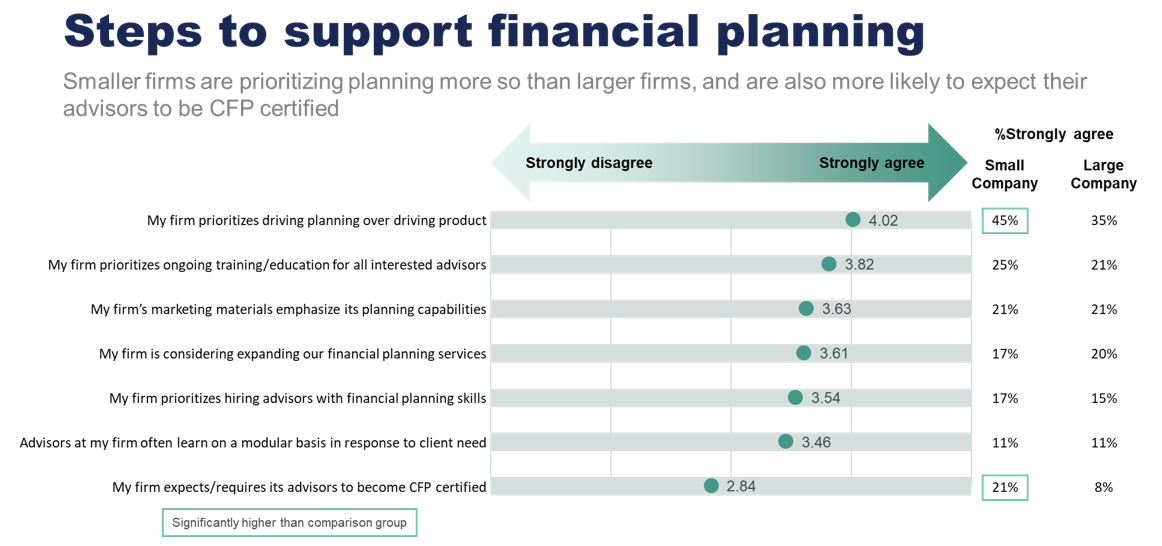

Smaller firms may be leading the way when it comes to prioritizing planning—at least according to their advisors. The advisors at smaller firms are much more likely to say they agree that their firm prioritizes planning over selling products (45 percent of respondents in small firms versus 35 percent of respondents in large firms). Small firms are also much more likely to require their advisors to be certified financial planners (CFP® professionals), which creates a level of fiduciary trust with clients that complements an increased focus on planning. 1

In comparison, larger firms have different priorities. They’re much more focused on developing training programs and/or building a centralized team responsible for financial planning. 1

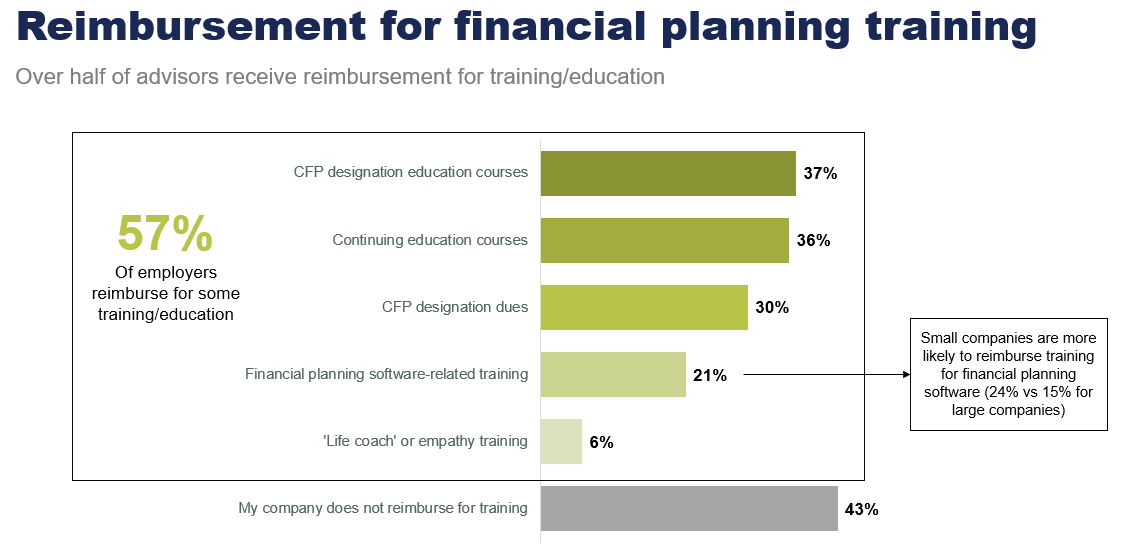

Across both small and large firms, 57 percent of employers are reimbursing financial advisors for some form of training or education—something to consider as you attempt to roll out planning across your organization. Smaller firms are more likely to reimburse training expenses for financial planning software (24 percent versus 15 percent, respectively), which can be invaluable in shortening the time to plan delivery. 1

Expectations for home office support among financial advisors will vary widely based on the size of your firm. Ensure that you’re focusing on the right approach to education, training, and level of support based on your approach to planning.

Advisors who put planning at the core of their service offering—which in our study we define as offering plans to more than half of clients—tend to see superior results. They see better client outcomes, offer a higher volume of plans, and charge a premium for their services. 1

In our research, advisors who lead with planning reported that they: 1

This focus on planning also leads to a better experience for clients. Client successes among planning-focused advisors include: 1

Not surprisingly, advisors seeing the above business and client successes are much more likely to be employed by firms that value and promote planning by prioritizing planning, providing training, marketing, and hiring advisors with planning skills and certifications.1

To attract these successful advisors, firms should increase their overall focus on planning by pursuing these tactics.

Identifying the right ways to promote planning is the key to helping advisors see more planning success. The strategies and tactics listed in this blog can provide a starting point for your firm to consider exactly how to approach scaling financial planning across the whole business.

If you want to continue learning about planning success, take a deeper dive into our research and see what successful advisors are doing to grow their firms by reading our recent blog Growing Your Financial Planning Practice by Leading with Planning.

Source:

1. eMoney Leading with Planning Research, May 2022, Advisors n=360

DISCLAIMER: The eMoney Advisor Blog is meant as an educational and informative resource for financial professionals and individuals alike. It is not meant to be, and should not be taken as financial, legal, tax or other professional advice. Those seeking professional advice may do so by consulting with a professional advisor. eMoney Advisor will not be liable for any actions you may take based on the content of this blog.

You may also be interested in...

If your institution’s advisors have traditionally focused on sales rather than planning, you might be facing a common challenge: resistance… Read More

A financial planner’s time is precious, and chances are, you sometimes feel like you’re not squeezing all the juice out… Read More

If you’ve dipped your toes into the concept of transparency in financial planning, you probably have a solid grasp on… Read More

Download this eBook now and learn how AI is expected to impact the industry.

Download Nowa new source of expert insights for financial professionals.

Get StartedTips specific to the eMoney platform can be found in

the eMoney application, under Help, eMoney Advisor Blog.