Help Preserve Your Client’s Legacy by Optimizing the Family Meeting

Navigating wealth and legacy can be challenging. However, with proper preparation and communication, financial professionals can play a crucial role… Read More

Insights and best practices for successful financial planning engagement

• Anand Sekhar • March 22, 2023

Despite the global and market upheaval over the past few years, millions of Americans have started investing. And 60 percent of young investors (ages 18–34) began investing after 2020.1

Generations Y (Millennials) and Z are seeking financial advice today and they are likely to pursue providers who meet their needs now. Although it may be difficult for some advisors to consider serving this not-yet-affluent group, advisory businesses that don’t take steps to target young investors could be missing out on a sizable—and vital—opportunity.

It is essential for advisors to get educated on the needs of these younger investors now so they can begin making strategic adjustments as they seek to serve them well and profitably.

The portion of the U.S. population represented by Gen Y (73.2 million) and Gen Z (67.8 million) comprises nearly 50 percent of the total population. Yet they represent only 14 percent of today’s advisory clients.2

Additionally, with the significant wealth set to shift in their direction, both their size and financial potential means they could play a pivotal role in the growth, valuation, and long-term success of your firm.

Contrary to the beliefs of many advisors, young investors can be attractive and profitable clients, especially over time. Our research shows3 that Gen Y and Z are:

They are also establishing their first financial advice relationships. In fact, the Fidelity Investments 2022 Investor Insights Study found that 63 percent of GenY and Gen Z believe working with an advisor is key to achieving financial success.4

The key however is to select the right next-gen clients that may add to the overall growth and longevity of your firm.

Fidelity analysis5 shows that an individual’s savings rate and service level are the two biggest factors in determining the long-term profitability of a client—and sometimes clients with higher assets or incomes aren’t the most valuable to your business over time.

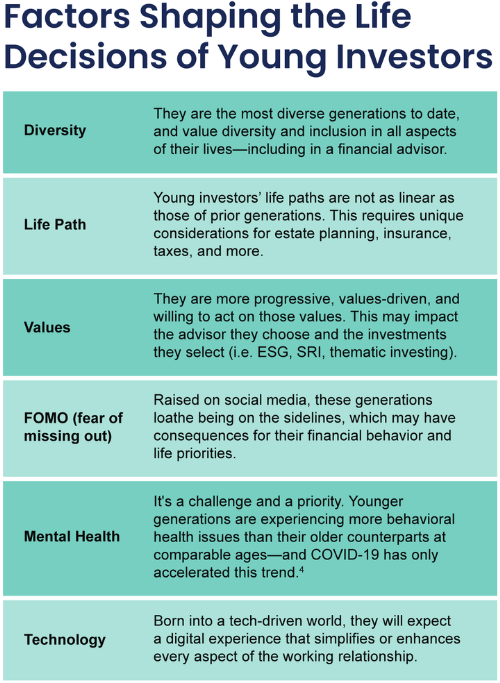

As with any cohort, young investors are not a monolithic group—and their individual needs and preferences differ due to a host of factors from life stage to upbringing to income. However, there are a number of attitudinal and cultural similarities between Gen Y and Gen Z investors that influence how they make decisions about their lives, careers, and finances.

Below are six hallmarks to consider when providing financial planning to Millennials and Gen Z.

Source: Fidelity Investments, “It’s Time to Change Your Mind about Young Investors”

When it comes to determining the best ways to engage with young investors, it may pay to keep in mind the ways in which they are redefining advice relationships. Gen Y and Gen Z are still relatively young in their financial journeys, but they have different needs and preferences when it comes to their money and the advisors with whom they work.

For advisors interested in delving into this market and positioning their businesses for long-term success, consider following this three-step approach focused on foundation, evolution, and innovation.

Many financial advisors may be skeptical about serving young investors because they don’t think they can afford financial advice or be served profitably. However, ignoring young clients has the potential to impact the growth and value of your firm, as well as the long-term sustainability of your business.

Taking steps now to engage these clients will benefit not only your business but the individual clients you serve. The undeniable truth is that young investors are seeking financial advice today. If an advisor can’t serve their needs, Millennials and Generation Z will find someone who can.

To learn more about engaging with Generations Y and Z, read the full Fidelity eBook It’s Time to Change Your Mind about Young Investors, How the next generations can help your firm grow, and what you can do to win their business.

Sources:

1 CNBC | Momentive Poll: “Invest in You,” August 2021.

2 Fidelity Investments, Analysis of ~3,700 on-platform firms (as of December 2021).

3 Fidelity Investments 2022 Investor Insights Study, August 8 through September 2, 2022, n= 2,490 investors age 21 or above with household investable assets of $50K or more.

4 Fidelity Investments 2022 Investor Insights Study, August 8 through September 2, 2022, n= 2,490 investors age 21 or above with household investable assets of $50K or more.

5 Fidelity Investments 2022 Investor Insights Study, August 8 through September 2, 2022, n= 2,490 investors age 21 or above with household investable assets of $50K or more.

6 Sapien Labs, “The Deteriorating Social Self in Young Generations,” May 2022.

DISCLAIMER: The eMoney Advisor Blog is meant as an educational and informative resource for financial professionals and individuals alike. It is not meant to be, and should not be taken as financial, legal, tax or other professional advice. Those seeking professional advice may do so by consulting with a professional advisor. eMoney Advisor will not be liable for any actions you may take based on the content of this blog.

The views and opinions expressed by this blog post guest are solely those of the guest and do not necessarily reflect the opinions of eMoney Advisor, LLC. eMoney Advisor is not responsible for the content, views or opinions presented by our guest, nor may eMoney Advisor be held liable for any actions taken by you based on the content, views or opinions of the guest.

The 2022 Fidelity Investor Insights Study was conducted during the period August 8 through September 2, 2022. It surveyed a total of 2,490 investors, including 673 millionaires and 1,520 investors with advisors. The study was conducted via an online survey, with the sample provided by Brookmark, a third-party firm not affiliated with Fidelity. Respondents were screened for a minimum level of $50K in investable assets (excluding retirement assets and primary residence), with additional quotas by age and affluence levels.

eMoney Advisor LLC is a Fidelity Investments company and an affiliate of Fidelity Brokerage Services LLC and National Financial Services LLC.

Fidelity Institutional®(FI) provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC

1076708.1.0

You may also be interested in...

Navigating wealth and legacy can be challenging. However, with proper preparation and communication, financial professionals can play a crucial role… Read More

Episode Summary A passionate advocate for women in the financial space, Cary Carbonaro, CFP®, MBA, Managing Wealth Advisor, Women and… Read More

The financial services landscape is beginning to feel the impact of advancements in artificial intelligence (AI) and machine learning technologies. Read More

Download our latest eBook for a complete guide to asking questions that spark productive conversations.

Download Nowa new source of expert insights for financial professionals.

Get StartedTips specific to the eMoney platform can be found in

the eMoney application, under Help, eMoney Advisor Blog.