5 Ways to Help Clients Build Financial Resilience

Financial planning is most effective when it accounts for the realities of change, uncertainty, and transition. Markets shift, careers evolve,… Read More

Insights and best practices for successful financial planning engagement

• Daniel Bryant • July 12, 2022

Right now, I believe we are experiencing a coalescence of the optimal conditions necessary for retirement advisors to reap the benefits of the financial wellness support they offer to employers in support of a healthy workforce.

There’s no question that employers are experiencing the fallout that a sub-par financial education has had on their employees. Young adults beginning their working lives lack an understanding of the true worth of that first paycheck and money issues escalate from there. It may be a challenging time, but employers can play a pivotal role in getting their employees on the right financial footing.

And more and more, employees are viewing their employer as the right resource to guide their financial lives with retirement advisors well-positioned to help make that connection.

It’s important to understand the employees we are talking about. Demographics significantly impact the magnitude of the workplace financial wellness issue. There are nearly 140 million Millennials and Gen Zs in the under 45-year-old cohort.1

These folks are digital natives and crave experiential living—characteristics that make for an interesting combination. They struggle with how to prioritize their debt burdens and savings while also feeling the need to live in the moment.

Most have never met with a financial planner, yet they will be inheriting money from the Baby Boomer. It’s imperative that they get started on the right path to financial wellness before it’s too late.

Changes in the dynamics of the employer-employee relationship mean there’s never been a better time for retirement advisors to connect with employers and offer assistance.

The employee-employer relationship has been shifting for some time and there’s no question the pandemic has accelerated that shift. Whereas employees were once viewed as a commodity, there is now a greater emphasis on their overall well-being—and especially on their financial wellness.

In fact, the changing role of employers was acknowledged by the Business Roundtable Association in 2019. In its statement, the members of the roundtable asserted that the responsibilities of employers now include employee well-being, mental health support, corporate citizenship, sustainability, and the access, support, and resources needed to improve financial literacy.

As HR teams have evolved to meet these changes, they have been inundated with an expanding list of complex benefits to manage on behalf of their workforce. Fortunately, the rapid development of technology-related financial wellness solutions offers a means for employers to get secure, personalized solutions to their employees.

Retirement advisors who can offer the desired combination of human advice partnered with self-directed tech support are key to helping employers as they navigate this new employee relationship. Stronger employees mean stronger businesses with more opportunities for retirement benefit partnerships.

As employers become more empathetic, younger workers who gravitate to this style of leadership will naturally seek out the companies exhibiting these behaviors, thus giving them an edge in a competitive labor market. As such, retirement advisors can work with employers who want to take steps to help their employees make up for their lack of financial literacy.

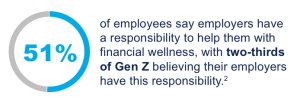

And as previously mentioned, employees expect their employers to play this role. Fifty-one percent of employees say employers have a responsibility to help them with financial wellness, with two-thirds of Gen Z believing their employers have this responsibility.2

When it comes to getting started, there’s no better time than when an employee joins the company. This is especially true when they are at the very beginning of their career. Most don’t understand the limitations of their salary—even those who start out in relatively high-earning positions.

Financial professionals can work with employers to embed the learning experience into their onboarding process. Provide basic guidance to walk employees through the big financial decisions that come along with that first paycheck such as paying for housing and bills, figuring out transportation, and setting up a budget.

Many may not understand that their salary is not what they take home. In fact, they should estimate that 30 percent of their salary will go to taxes in addition to deductions for health insurance, 401(k) and HSA investments, and other benefits the employer may provide.

Beyond helping them understand the deductions coming out of their paychecks, provide guidance on how best to allocate their take-home pay. Lessons like the 50/30/20 rule can ensure they are able to meet their needs, wants, and savings goals.3

If you are able to get employees started on the right track as soon as they join the workforce that’s ideal. But don’t forget about those who have been in the workforce for a while. There are likely opportunities to connect with employees of all ages across a workforce who would benefit from going back to basics.

Employers are searching for ways to maintain their competitive edge while doing what’s right for their employees. From the employer’s perspective, it’s a daunting task. Don’t wait for them to come to you for solutions. Help employers stay ahead of their employees’ retirement and financial wellness needs by continuously showing the value your partnership offers.

Create an atmosphere of holistic advice using an empathetic approach. Show companies that when you engage with their employees about their wellness, those employees will see their employers as caring and be much more likely to stand by them in challenging times.

DISCLAIMER: The eMoney Advisor Blog is meant as an educational and informative resource for financial professionals and individuals alike. It is not meant to be, and should not be taken as financial, legal, tax or other professional advice. Those seeking professional advice may do so by consulting with a professional advisor. eMoney Advisor will not be liable for any actions you may take based on the content of this blog.

The views and opinions expressed by this blog post guest are solely those of the guest and do not necessarily reflect the opinions of eMoney Advisor, LLC. eMoney Advisor is not responsible for the content, views or opinions presented by our guest, nor may eMoney Advisor be held liable for any actions taken by you based on the content, views or opinions of the guest.

Sources:

1 “Resident Population in the United States in 2020, by Generation.” Statistica, 2021. September 10. Resident population in the United States in 2020, by generation.

2 “TIAA 2022 Financial Wellness Survey.” TIAA, 2022. January 1. https://www.tiaa.org/public/pdf/2022_financial_wellness_survey_final_results.pdf.

3 Whiteside, Eric. “What Is the 50/20/30 Budget Rule?” Investopedia, 2022. March 5. https://www.investopedia.com/ask/answers/022916/what-502030-budget-rule.asp.

You may also be interested in...

Financial planning is most effective when it accounts for the realities of change, uncertainty, and transition. Markets shift, careers evolve,… Read More

Many financial professionals see the annual calendar change as a time to look for future opportunities. For forward-thinking financial planners… Read More

Episode Summary Brendan Frazier serves as Chief Behavioral Officer at RFG Advisory, where he leads the integration of behavioral finance… Read More

Download this eBook now and learn how AI is expected to impact the industry.

Download Nowa new source of expert insights for financial professionals.

Get StartedTips specific to the eMoney platform can be found in

the eMoney application, under Help, eMoney Advisor Blog.