Understanding the Challenges of a Client’s Scarcity Mindset

Anxiety stemming from finances has always existed and continues to be one of the top stressors for many Americans,1 particularly… Read More

Insights and best practices for successful financial planning engagement

• Joe Buhrmann • October 7, 2025

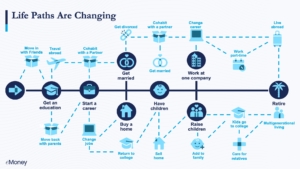

For many years, financial planning remained somewhat static. Our lives were less complicated, and the processes were mostly linear: maybe go to college, get a job, get married, buy a home, have a family, work a few jobs, and get a gold watch when we retire. Financial planning clients veering from this trajectory were typically outliers.

However, all that has changed over the past two decades. Most of our clients’ lives (and finances) have become more complicated, and the paths clients take are more diverse and anything but linear.

As financial planners, we recognize that our jobs are inherently complicated, requiring mastery of markets, regulations, technologies, and strategies. Yet, the true nature of working closely with people is not only complicated but also complex.

Each client brings singularly unique dreams, fears, and challenges. Furthermore, clients’ financial decisions are deeply intertwined with emotions, family dynamics, and personal values, making financial planning a complex process. Planners cannot simplify a person’s financial history, personality, risk tolerance, and relationship with money, which all influence their goals and behaviors in ways that spreadsheets don’t show.

Add to that the dynamics of couples, multi-generational families, or business partners, and the layers of complexity multiply. Navigating these human elements—such as trust, communication, and emotional biases—is what elevates financial planning from a technical job to a nuanced practice of empathy and connection.

As complications and complexity increase, being a competent, credentialed, and compliant financial planner may no longer be enough to have a truly thriving practice. Clients face unprecedented complexity: volatile markets, new regulations, shifting tax landscapes, and evolving priorities. As expected, clients’ expectations of what a good financial planner is also changing.

To stay current, the financial planning profession is undergoing profound change, and planners who want to remain relevant will want to uplevel their skills. Market volatility, inflation pressures, and rising interest rates are shifting the way clients think about risk and return. And that’s not all:

These are not the only factors driving financial planners to improve, but they are among the most significant.

The good news for planners is that going from good to great has never been more within reach. There are a bounty of tools and teachings available that can improve every aspect of your practice. But where to start?

When looking to uplevel your practice start with these pillars of success–now, and in the future:

In a world where clients demand personalization, education, and purpose, great advisors rise by doing more than managing assets—they help shape lives. By leading with empathy, strategy, empowerment, connection, and purpose, advisors not only stay relevant but also future-proof their practices.

One of the best ways of being a great planner is not in retaining clients, but in retaining client families from generation to generation. However, this is harder than you may think. Studies show that 70 percent of women leave their financial advisor within one year of losing a spouse.3 This statistic underscores the tremendous opportunity—and responsibility—financial planners have to deepen their client relationships.

The road to greatness lies in actively engaging both partners in the financial planning process and creating strategies that foster trust and inclusivity. Moving from “good to great” as a financial planner requires building relationships that aren’t just transactional, but transformational. So how can you achieve this? The following are actionable steps to ensure you’re not only prepared to serve families better but to create a dynamic and lasting financial partnership.

1. Facilitate Equal Participation

It’s not unusual for one spouse to take the lead in a couple’s financial discussions, often creating an imbalance in engagement. To avoid this:

2. Tailor Communication Styles

Couples are rarely identical in how they understand and relate to finances. Some may be savers versus spenders. Others may differ drastically in financial literacy or approach to risk. As their advisor, it’s your responsibility to adapt:

3. Schedule Regular Joint Check-Ins

Time is your greatest ally in building a robust client relationship. Instead of sporadic updates, formalize routine touchpoints that focus on holistic goals:

By engaging both spouses (and, if applicable, their children) and fostering genuine connections, you are more effective at retaining clients, which in turn strengthens your value as a financial planner. This approach enhances trust, reduces the risk of losing business, and improves client satisfaction—hallmarks of great financial planners.

By going beyond the transactional and nurturing a truly inclusive financial partnership, you position yourself to thrive in an evolving industry that increasingly prizes emotional intelligence as much as technical skill. Great financial planners don’t just manage money—they transform lives through empathy, learning, and communication.

To learn more about retaining clients, read our blog post Crafting A Client Retention Strategy: Best Practices for Financial Planners.

1 Cerulli, Cerulli Anticipates $124 Trillion in Wealth Will Transfer Through 2048, 2024

2 Capgemini, North America high-net-worth individual population surges, while Europe and Middle East shrink, 2025

3 ThinkAdvisor, Teresa J.W. Bailey, How to Keep Female Clients After the Loss of a Spouse, 2024

DISCLAIMER: The eMoney Advisor Blog is meant as an educational and informative resource for financial professionals and individuals alike. It is not meant to be, and should not be taken as financial, legal, tax or other professional advice. Those seeking professional advice may do so by consulting with a professional advisor. eMoney Advisor will not be liable for any actions you may take based on the content of this blog.

You may also be interested in...

Anxiety stemming from finances has always existed and continues to be one of the top stressors for many Americans,1 particularly… Read More

Financial planning is most effective when it accounts for the realities of change, uncertainty, and transition. Markets shift, careers evolve,… Read More

The rise in wealth controlled by women1 signals one of the most significant demographic shifts in the industry, yet many… Read More

Download this eBook now and learn how AI is expected to impact the industry.

Download Nowa new source of expert insights for financial professionals.

Get StartedTips specific to the eMoney platform can be found in

the eMoney application, under Help, eMoney Advisor Blog.