5 Ways to Help Clients Build Financial Resilience

Financial planning is most effective when it accounts for the realities of change, uncertainty, and transition. Markets shift, careers evolve,… Read More

Insights and best practices for successful financial planning engagement

• Mac Gardner • April 5, 2021

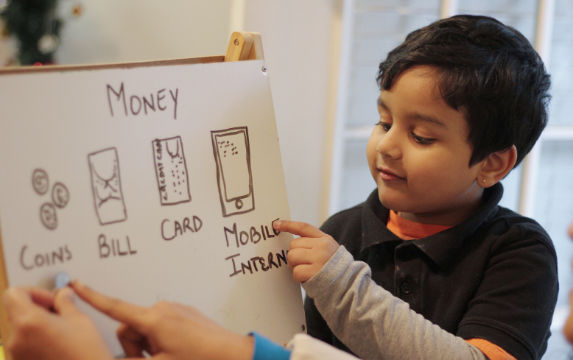

Financial education—and the literacy gained from it—provides the foundation for achieving financial wellness. Without a fundamental financial education, it’s difficult to understand the concepts associated with being financially well.

Yet attaining financial literacy—the awareness and understanding of how money works and how to handle it responsibly—is a struggle in the U.S. According to the S&P Global Financial Literacy Survey, the U.S. ranks 14th globally with 57 percent of adults being financially literate.1

In fact, according to the FINRA Investor Education Foundation, the financial literacy rate among Americans has decreased from 42 percent to 34 percent between their benchmark 2009 survey and its most recent iteration in 2018.2

To understand falling financial literacy rates, we need to understand some of our nation’s history of teaching personal finances. The concept of formal financial education started over a hundred years ago when the Cooperative Extension Service was established to offer outreach programs to educate rural Americans about a range of topics—among them personal finance.

However, implementation of financial education has been inconsistent, with much debate about the best time and place to offer it. Only 21 states require some sort of financial education as part of their high school curriculum.3

So, if our public schools are not providing consistent personal finance education, where is the guidance coming from? For many people, the answer is parents or other family members—or they have worked to educate themselves. This lack of opportunity to acquire a financial education while young has consequences that last a lifetime.

Low financial literacy rates can have an immediate impact on young adults and the decisions they make early in their lives—one of which could be taking out too many student loans. If the pressure is on to continue with higher education, a student who doesn’t understand how loans work may make a poor student loan decision that has a lasting influence on their future goals and plans.

Another challenging money decision involves taking on too much credit card debt. Without fully understanding interest rates and minimum payments, that spending can lead to a financial hole that can be hard to climb out of.

And these challenges can stay with people as they get older. The Federal Reserve’s Report on the Economic Well-Being of U.S. Households in 2018 revealed that nearly a quarter of American adults have no retirement savings or pension.4

This same study revealed that of those who do have a self-directed retirement savings account—such as a 401(k)—sixty percent have a low comfort level with making investment decisions for these accounts.

These statistics demonstrate the way improved financial literacy can help remove poor financial outcomes. It empowers people with the knowledge to make smart decisions about their personal finances which helps put them on a path to form a plan and then track it to reach their personal financial goals.

The poor state of financial literacy is not going unnoticed and while making changes to bureaucratic systems and institutions for its improvement will take time, there are ways to get involved to make a difference. Financial professionals can make an immediate impact beginning with their existing client relationships.

Approach your client interactions with an attitude of education. Have conversations that walk them through the concepts of investment management, debt reduction, risk tolerance and mitigation, and budgeting. Make sure they understand the documents they are completing as well as what is being done with their money and why.

And don’t stop with your adult clients. Offer to speak with their children about finances or take steps to enable your clients to do so themselves. This is one small step that can give the next generation a head start on their financial wellness.

To take things even further, check for opportunities in your local community. Many organizations and schools are advocating for increased financial literacy. It is likely they would be receptive to the involvement of a financial professional.

Advice on ways to improve financial wellness is as close as a search online. However, many of the provided tips require a certain level of financial understanding. It’s tough to implement debt reduction strategies or plan for retirement when you don’t know where to begin.

Financial professionals are uniquely suited to effect change. Whether you start by focusing on client education or decide to take your expertise to your community, your skills can make a real difference.

Part 2 of this series will go into more depth on the role financial advisors play in financial literacy and the business benefits of improving it. You can also learn more by watching our on-demand webinar where I host a panel of financial professionals to discuss the importance of financial education and literacy.

DISCLAIMER: The eMoney Advisor Blog is meant as an educational and informative resource for financial professionals and individuals alike. It is not meant to be, and should not be taken as financial, legal, tax or other professional advice. Those seeking professional advice may do so by consulting with a professional advisor. eMoney Advisor will not be liable for any actions you may take based on the content of this blog.

The views and opinions expressed by this blog post guest are solely those of the guest and do not necessarily reflect the opinions of eMoney Advisor, LLC. eMoney Advisor is not responsible for the content, views or opinions presented by our guest, nor may eMoney Advisor be held liable for any actions taken by you based on the content, views or opinions of the guest.

1 Standard & Poor’s Ratings Services Global Financial Literacy Survey

2 The National Financial Capability Study (NFCS) is a project of the FINRA Investor Education Foundation (FINRA Foundation)

3 Council for Economic Education, Survey of the States, Economic and Personal Finance Education In Our Nation’s Schools, 2020

4 Board of Governors of the Federal Reserve System, Report on the Economic Well-Being of U.S. Households in 2018 – May 2019

You may also be interested in...

Financial planning is most effective when it accounts for the realities of change, uncertainty, and transition. Markets shift, careers evolve,… Read More

Many financial professionals see the annual calendar change as a time to look for future opportunities. For forward-thinking financial planners… Read More

Episode Summary Brendan Frazier serves as Chief Behavioral Officer at RFG Advisory, where he leads the integration of behavioral finance… Read More

Download this eBook now and learn how AI is expected to impact the industry.

Download Nowa new source of expert insights for financial professionals.

Get StartedTips specific to the eMoney platform can be found in

the eMoney application, under Help, eMoney Advisor Blog.