Why Teaching Clients May Be Your Most Strategic Asset in 2026

Many financial professionals see the annual calendar change as a time to look for future opportunities. For forward-thinking financial planners… Read More

Insights and best practices for successful financial planning engagement

• Joe Buhrmann • December 27, 2022

As client expectations continue to evolve, there is an opportunity for financial planners to broaden and deepen their service offerings by providing holistic financial planning. In fact, of the financial advisors we surveyed, 92 percent expect that holistic planning will grow in the next five years and 53 percent expect that growth to be moderate to extreme.1

To successfully make a move to a more holistic service offering, advisors must gain an understanding of the value clients seek in their services. One way to assess this is to look at the value of financial advice as it stacks up to basic human needs.

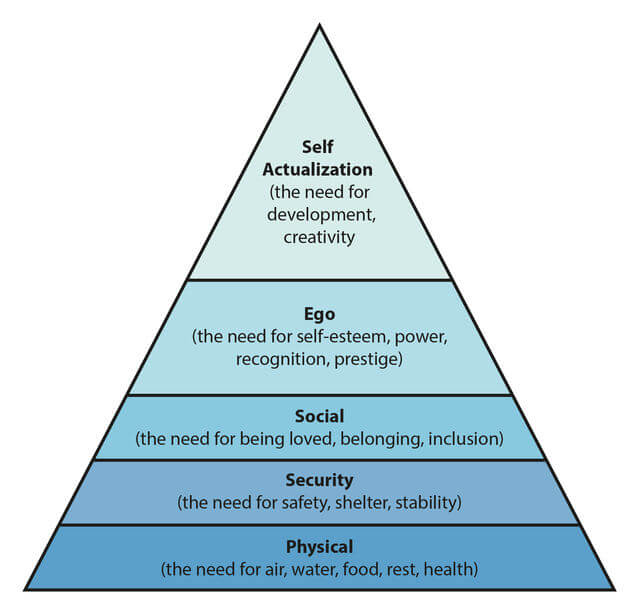

Maslow’s hierarchy of needs is a motivational theory in psychology comprising a five-tier model of human needs, often depicted within a pyramid. Since its introduction in 1943, this hierarchy has been used as an assessment tool for many disciplines beyond psychology—including finance.

In today’s world, money is one of the primary tools that allows one to achieve some of the most basic needs outlined in the original theory. For example, the physiological needs at the base of the pyramid comprise what the human body needs to survive—food, water, shelter, and clothing—all things that can be purchased. Even the needs of security and safety in the next level can be achieved through financial means.

As one moves up the pyramid, additional needs are introduced beyond the basics to encompass psychological and ultimately self-fulfillment needs. While these are less financially dependent, money often plays a role in their achievement.

It makes sense that parallels can be drawn from the levels of this needs pyramid to a similar structure based on financial needs. Thus, the financial professional has an enormous role to play in helping clients meet their needs at every level of the hierarchy.

In 2020, The Advisor Channel (founded by partners New York Life Investments and Visual Capitalist) created a hierarchy that categorizes financial needs and demonstrates how wealth management plays an important role in financial health.2

This tool classifies five levels in the hierarchy of financial needs beginning with the basics and moving up from there.

1. Cash flow and basic needs encompasses food, housing, and daily expenses and ensures the fundamentals, including physiological needs, are covered financially.

2. Financial safety includes insurance and an emergency fund to help prepare for unforeseen events and risks.

3. Accumulating wealth refers to growing investments, paying down debt, and saving for retirement. At this level, the focus shifts to growing assets for long-term success and longevity.

4. Financial freedom advances to long-term care and children’s education, as well as retirement savings and vacations. These financial needs are linked to Maslow’s hierarchy esteem needs, such as self-respect and personal accomplishment.

5. Legacy covers estate and tax planning, and business succession planning if applicable, connecting with self-actualization in Maslow’s pyramid.

One criticism of Maslow’s original theory was that it states that a lower level must be completely satisfied and fulfilled before moving on to a higher pursuit, but there is evidence to suggest that levels continuously overlap each other.3

Naturally, this holds true for the hierarchy of financial needs as well as they can shift based on a given situation. But as a general rule of thumb, moving along this path can help create a roadmap to financial health.

I’ve witnessed this situation in my own practice during client meetings. For younger investors—who are just getting started—determining and analyzing cash flow can be paramount to moving up the pyramid. However, the need to assess cash flow doesn’t go away as you move up the pyramid.

For example, when discussing legacy and charitable concerns, advisors often return to cash flow and the way it is impacted when it comes to gifting and charitable strategies.

When the role of the advisor is juxtaposed with the hierarchy of financial needs, it’s not difficult to see the power of the advisory field. Our partners at Fidelity developed a concept that speaks to how the wealth management business can continue to provide value to clients.4

At the base, we see activities like selecting money managers, figuring out an ideal asset allocation, and choosing the right securities to get you to that allocation—the right stocks, bonds, funds, or ETFs—and while those activities are fundamental to any client-advisor relationship, the issue here is that today’s technology is quickly commoditizing many of those functions.

Moving up the pyramid we find traditional goal planning—retirement and college funding, purchasing a home or car, or planning for major expenses. Beyond that, it’s helping clients with peace of mind by protecting their plans with insurance and risk management, so that clients feel more control in their lives. Lastly, the peak represents life’s fulfillment and leaving a legacy to family or to charity.

The race to zero is already well underway. Investors have embraced free stock trades, signaling the end of the conventional and discount brokerage model. To provide true, lasting value to clients, advisors must move further and further up the value stack, where services are not being commoditized left and right.

People don’t generally define wealth as being solely about money. After all, the definition of being rich is as personal as the definition of happiness. The connection between personal wealth and well-being can be impacted by a myriad of factors outside of anyone’s control.

The holistic financial planning process goes beyond traditional financial planning to help clients achieve the best outcomes as defined by their individual needs. It’s about incorporating more life events—large and small—which allows for agile, “just in time” planning. It adds a level of engagement that was previously unavailable and provides financial professionals with an opportunity to offer the personalized service clients crave.

DISCLAIMER: The eMoney Advisor Blog is meant as an educational and informative resource for financial professionals and individuals alike. It is not meant to be, and should not be taken as financial, legal, tax or other professional advice. Those seeking professional advice may do so by consulting with a professional advisor. eMoney Advisor will not be liable for any actions you may take based on the content of this blog.

Sources:

1 eMoney Leading with Planning Research, May 2022, Advisors n=360

2 Neufeld, Dorothy. “Visualizing the Hierarchy of Financial Needs.” Advisor Channel, 2020. September 17. https://advisor.visualcapitalist.com/hierarchy-of-financial-needs/.

3 Deckers, Lambert. Motivation: Biological, Psychological, and Environmental. Routledge Press, 2018. ISBN 9781138036338.

4 2020 Fidelity Financial Advisor Community (FAC), Financial Planning Study, January 2020, n=393

You may also be interested in...

Many financial professionals see the annual calendar change as a time to look for future opportunities. For forward-thinking financial planners… Read More

Episode Summary Brendan Frazier serves as Chief Behavioral Officer at RFG Advisory, where he leads the integration of behavioral finance… Read More

The world of financial planning is undergoing a series of profound transformations.1 Gone are the days when financial advisors were… Read More

Download this eBook now and learn how AI is expected to impact the industry.

Download Nowa new source of expert insights for financial professionals.

Get StartedTips specific to the eMoney platform can be found in

the eMoney application, under Help, eMoney Advisor Blog.