Understanding the Challenges of a Client’s Scarcity Mindset

Anxiety stemming from finances has always existed and continues to be one of the top stressors for many Americans,1 particularly… Read More

Insights and best practices for successful financial planning engagement

• Emily Koochel • August 23, 2022

As the scope of financial advice continues to expand into more areas of clients’ lives, financial psychology plays an increasingly important role in getting clients engaged and motivated to reach their goals.

The CFP Board’s 2021 introduction of Financial Psychology as a Principal Knowledge Topic cemented its importance for modern financial planners. Every client brings their own emotions, relationship, and history with money to the table—financial planners need to be ready to help clients overcome barriers and find greater peace of mind through more effective, personalized planning.

Our recent research1 into financial psychology reveals its prevalence in planning practices today, the benefits of having an understanding of it, and the most common barriers to implementing it.

To get an understanding of financial psychology’s prevalence in the industry, we first sought to understand advisors’ familiarity with it in relation to the topic of behavioral finance.

We found that 85 percent of advisors are at least somewhat familiar with the topic of behavioral finance, with 40 percent saying they’re very familiar with it. This is compared to 71 percent who are at least somewhat familiar with financial psychology and just 26 percent who say they are very familiar with it.

We believe this discrepancy in familiarity may be due in part to the fact that behavioral finance has been around longer. Behavioral finance is a subfield of behavioral economics and gained widespread popularity in the 1970s.

To advisors, definitions of behavioral finance were decision- and action-oriented, with the most common definition cited as “Psychological factors that influence how clients (or markets) act/behave.”

Definitions for financial psychology implied a more emotive state towards money, with the most cited definition being “The client’s relationship/emotions towards money and investing.”

The topic of financial psychology speaks to a deeper range of emotions than the topic of behavioral finance, including how a client’s relationship with money was formed over their lifetime, as well as how that relationship impacts their life and finances today.

The complexity of getting to the heart of someone’s relationship with money may contribute to financial psychology’s lesser familiarity among advisors perpetually seeking efficiencies in their planning processes.

Financial advisors widely agree that putting financial psychology into practice is important. Interestingly, younger advisors (45 and under) are more familiar with financial psychology, but more experienced advisors (46 and older) believe more strongly that financial psychology is important to use in the planning process.

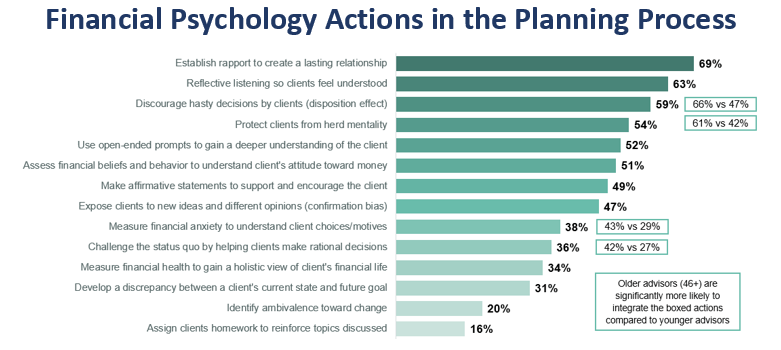

In terms of how financial psychology is implemented in planning, advisors report that establishing rapport to build a long-term relationship and practicing reflective listening are the two most common actions taken. Identifying ambivalence towards change and providing tasks to clients to reinforce discussion topics were among the least common action items.

While the graph above is not an exhaustive list, there’s certainly no lack of financial psychology actions financial advisors can put into practice. Older advisors, who more strongly believe in the importance of financial psychology, are significantly more likely to be implementing a number of tactics.

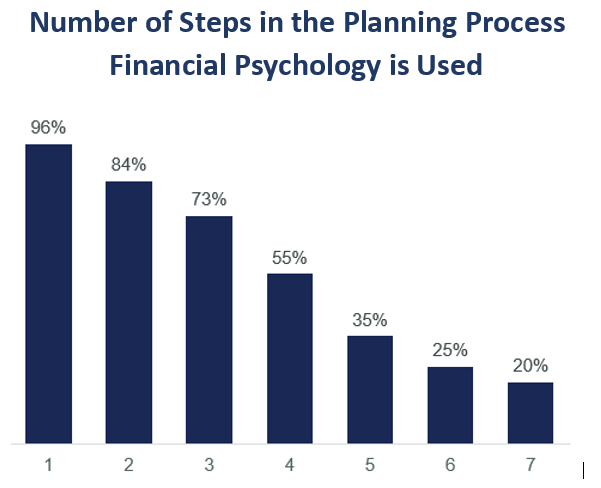

When looking at the level of integration of financial psychology in the planning process, the majority of advisors are using these principles in one or two steps of the planning process. Few advisors, however, are incorporating it into five or more steps of the planning process.

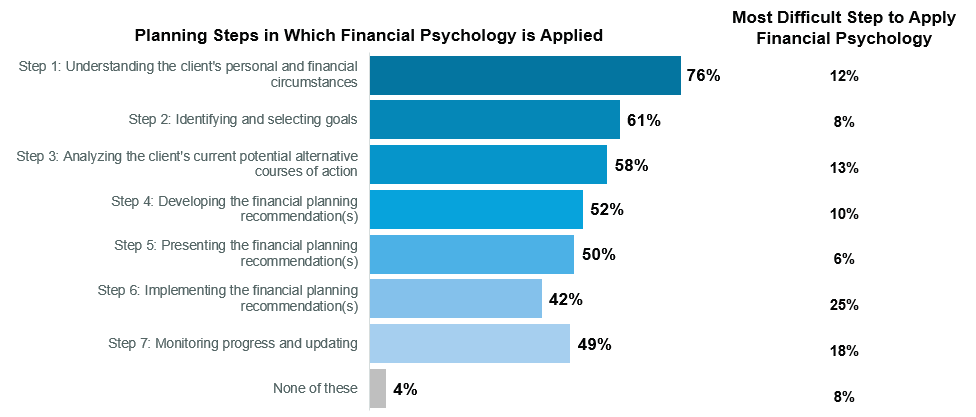

Advisors most commonly lean on financial psychology in step 1 of the CFP Board’s Financial Planning Process, Understanding the Client’s Personal and Financial Circumstances. They find that Implementing the Plan is the most difficult step in the planning process to incorporate financial psychology, and unsurprisingly, it is also the step where it’s least integrated.

Generally speaking, advisors are having a better time using financial psychology at the beginning of the financial planning process, where the client’s life circumstances and goals are discussed. They’re finding it harder to implement towards the end of the process, where action is taken and progress is measured.

While step 1 of the CFP Board’s Financial Planning Process naturally lends itself to more personal discussions with the client, it is important to recognize how this information can be utilized in other steps. For example, if you learn your client has an emotional attachment to their inherited money during your initial meetings, you may adjust the way you approach planning conversations about this money in later steps.

Our research shows that there are many benefits of incorporating financial psychology into each step of the financial planning process.

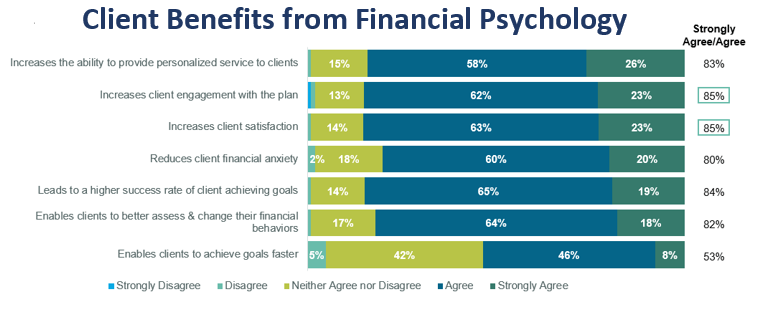

Over 80 percent of financial advisors believe that applying financial psychology benefits clients in a variety of ways. The sole exception is that only about 53 percent of advisors believe it can help clients achieve their goals faster.

Advisors believe the most common benefits of applying financial psychology are that it increases client engagement with the plan and increases client satisfaction—two extremely important aspects of successful planning.

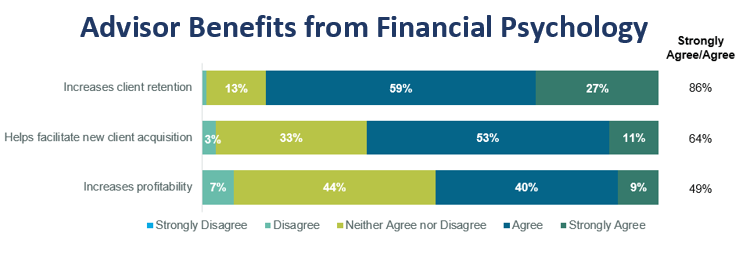

Advisors are also seeing benefits to their business, particularly in client retention and new client acquisition.

New client acquisition is a somewhat surprising benefit of financial psychology. Acquisition may be aided by a higher number of quality referrals from clients who are more satisfied with the level of service they’re receiving.

Only 49 percent of advisors say implementing financial psychology increases profitability, likely because of the added time involved in uncovering someone’s complex relationship with money. This underscores the importance of being able to quickly uncover a client’s goals and values to keep the relationship moving.

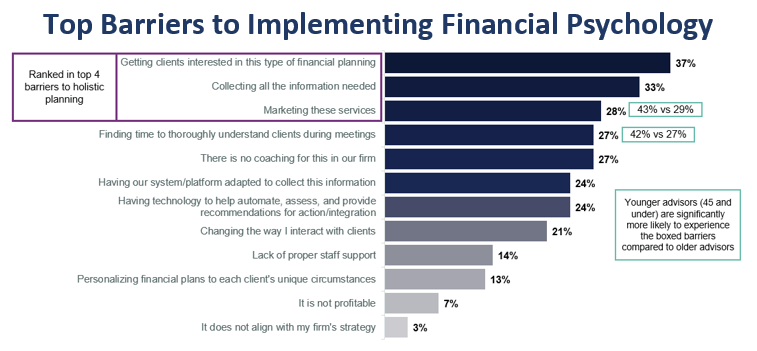

There are undoubtedly a number of client and advisor benefits that come from applying financial psychology. But there are also some common barriers advisors face in implementation.

Interestingly, the top three barriers listed here are also among the top four barriers to holistic financial planning. Advisors who want to provide a more holistic service for their clients—one that accounts for their deeply personal relationship with money—need to find ways to communicate and market these services to clients. Just as importantly, they need to find efficient ways of collecting client information and leverage technology for more effective planning workflows.

In addition to the barriers listed above, only 33 percent of advisors believe they have access to quality training and resources on financial psychology. Firms that want to lead the way in a more holistic type of planning should focus on providing advisors with the resources they need to learn about financial psychology.

A financial advisor’s job is inherently quantitative. But money is deeply personal, and the process of planning most often involves a client’s complex relationship with money. Planners who can engage with these emotions can motivate clients, plan more holistically, and improve planning outcomes.

Continue learning on the topic of financial psychology by reading our recent eBook Tapping into the Emotional Side of Planning.

Source:

1. eMoney Evolution of Advice Research, July 2022, Advisors n=300

DISCLAIMER: The eMoney Advisor Blog is meant as an educational and informative resource for financial professionals and individuals alike. It is not meant to be, and should not be taken as financial, legal, tax or other professional advice. Those seeking professional advice may do so by consulting with a professional advisor. eMoney Advisor will not be liable for any actions you may take based on the content of this blog.

You may also be interested in...

Anxiety stemming from finances has always existed and continues to be one of the top stressors for many Americans,1 particularly… Read More

Financial planning is most effective when it accounts for the realities of change, uncertainty, and transition. Markets shift, careers evolve,… Read More

The rise in wealth controlled by women1 signals one of the most significant demographic shifts in the industry, yet many… Read More

Download this eBook now and learn how AI is expected to impact the industry.

Download Nowa new source of expert insights for financial professionals.

Get StartedTips specific to the eMoney platform can be found in

the eMoney application, under Help, eMoney Advisor Blog.