5 Ways to Help Clients Build Financial Resilience

Financial planning is most effective when it accounts for the realities of change, uncertainty, and transition. Markets shift, careers evolve,… Read More

Insights and best practices for successful financial planning engagement

• Celeste Revelli • January 11, 2022

As a financial professional who studies and promotes financial wellness as a means to attain overall well-being, it comes as no surprise to me that our clients want to talk to us more about how they can achieve it.

When eMoney conducted research into the alignment between financial professionals and their clients on financial wellness, a number of interesting things came to light.1

Advisors continue to use a more traditional, narrow definition of financial wellness whereas clients defined financial wellness more broadly and less about specific plans and goals.

When asked about their definition of financial wellness, the financial professionals we polled most strongly—at 47 percent—associated it with meeting goals, plans, and investments. Clients on the other hand place the importance of this measure at only 22 percent as they spread their definition more evenly over a number of factors including financial health, growth, and independence at 25 percent and covering their needs or expenses and living a comfortable lifestyle at 24 percent.1

This divide was also present when each group was asked to articulate their own definition of financial wellness. Financial professionals used phrases like, “encompassing all aspects of finance” and “having strong cash flow, an emergency fund, and…investment mix.”1

Clients on the other hand provided definitions in line with the statistics above such as, “Having enough money…so you don’t have to worry” and “being prepared for my future and for any unexpected financial problems.”1

The difference is subtle, but I see it as financial professionals focusing on the tools and mechanics of working toward financial wellness, while clients are more focused on the peace of mind they’ll feel at its achievement.

Ultimately, financial professionals and clients want the same result. eMoney research revealed that both groups feel financial professionals can have a positive impact on their clients’ financial wellness.

When asked about their success in incorporating financial wellness discussions into their practice, only 61 percent of financial professionals say they have done so. Why is this the case when 86 percent feel they can impact their clients’ financial wellness and 87 percent of clients feel the same way?1

The answer could lie in the fact that the financial professionals we surveyed underestimate how receptive their clients are to financial wellness conversations.

Our study showed that 64 percent of financial professionals say their clients place importance on financial wellness, whereas 88 percent of clients say financial wellness is important to discuss.1

In addition, only 67 percent of financial professionals say their clients are receptive to financial wellness discussions, but 90 percent of clients say they are. In essence, there is a fairly equal and significant gap between how financial professionals and clients view the importance and receptivity of financial wellness discussions.1

This gap may in part be due to generational differences that exist in both the financial professional field and the clients they serve. For example, the clients of tomorrow (Gen Y) are significantly more likely to want increased touch points focused on financial wellness. Additionally, we learned that financial professionals are more likely to discuss financial wellness with clients who are their peers.1

While many financial professionals indicate that financial wellness is part of most conversations they have with clients, younger clients still want more. This is important to keep in mind as your client base shifts to include younger generations.

Eighty-six percent of clients seek an advisor to grow their wealth, and 85 percent seek an advisor for financial peace of mind.1 Today, a client’s financial well-being is just as important to them as their portfolio growth, but obstacles to achieving it still exist.

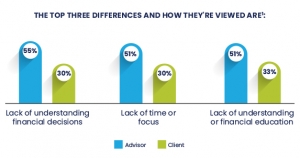

Our research also showed that financial professionals and their clients differ in their views of the level to which barriers are keeping them from achieving financial wellness.

*Multiple answer choices were allowed therefore the total will sum to more than 100%.

On top of this, 31 percent of respondents said difficulty getting sound advice was an obstacle to achieving financial wellness, and 34 percent said the inability to view their finances in one place was an obstacle.1

But no matter the barriers, 83 percent of financial professionals feel confident they can be overcome, and 87 percent of clients believe so as well.1

Now that you understand that your clients want to discuss financial wellness with you and work to overcome the barriers to achieving it, what can you do to bring the approach into your practice?

The primary means to give your clients what they want is to ask them. Just as each client’s financial plan will differ based on their lifetime financial needs, so will their view of their own financial wellness and what they require to feel peace of mind.

And don’t just ask once, incorporate a continuous process of examination into your client interactions. Ask them if they understand the elements of their plan. Ask them if they feel comfortable fulfilling the behaviors necessary to meet their goals. Ask them if there is anything holding them back.

Listen carefully to their responses and to any additional questions they ask you. Just as your relationship with your client started by gathering their existing financial data, so should you continue to work with them to keep that data fresh and up to date based on the client’s current situation and needs.

For more on how to align your practice with the desires of your clients while finding your own fulfillment as a financial professional, read our Planning with Purpose eBook.

Sources:

1 eMoney, Planning with Purpose Research, July 2021, Advisors n=393, End clients n=391

DISCLAIMER: The eMoney Advisor Blog is meant as an educational and informative resource for financial professionals and individuals alike. It is not meant to be, and should not be taken as financial, legal, tax or other professional advice. Those seeking professional advice may do so by consulting with a professional advisor. eMoney Advisor will not be liable for any actions you may take based on the content of this blog.

You may also be interested in...

Financial planning is most effective when it accounts for the realities of change, uncertainty, and transition. Markets shift, careers evolve,… Read More

Many financial professionals see the annual calendar change as a time to look for future opportunities. For forward-thinking financial planners… Read More

Episode Summary Brendan Frazier serves as Chief Behavioral Officer at RFG Advisory, where he leads the integration of behavioral finance… Read More

Download this eBook now and learn how AI is expected to impact the industry.

Download Nowa new source of expert insights for financial professionals.

Get StartedTips specific to the eMoney platform can be found in

the eMoney application, under Help, eMoney Advisor Blog.