The Future of Financial Planning: From Numbers to Mindsets

The world of financial planning is undergoing a series of profound transformations.1 Gone are the days when financial advisors were… Read More

Insights and best practices for successful financial planning engagement

• Paul Vieira • March 9, 2022

The pandemic has created what might be the perfect storm for employer-sponsored financial wellness benefits. Not only did Americans find themselves suffering financially as a result of the pandemic, but many have also taken stock of their lives and decided they want different things out of work than they used to.

Employers are finding that they have to compete harder than ever to attract and retain top talent and one of the ways they are doing this is by upping their employee benefits game. Cue financial wellness programs as a way to satisfy employees’ quest to improve their financial lives and for employers to distinguish themselves to job candidates.

One positive outcome of the pandemic is that it’s made more people aware of the importance of healthy finances. According to the TIAA 2022 Financial Wellness Survey, 51 percent of all Americans are now more aware of their overall financial wellness and 3 in 10 prioritize having an emergency fund more now than they did before.1

The same survey also found that 51 percent of employees say that employers have a responsibility to help them improve or maintain their financial wellness. These expectations are even higher when it comes to younger generations with two-thirds of Gen Z believing employers have this responsibility.

These younger workers are also more eager than other generations for financial wellness benefits. However, they do see barriers to engaging with employer financial wellness programs, including concerns about hidden costs and not wanting to disclose their finances to their employer.

Employer requirements for financial wellness programs will vary based on the specific needs of each company, so retirement advisors should first and foremost work with plan providers to explore these requirements.

Keep in mind that beyond the mechanics of the program, they’ll also want to see that you have a successful track record of working with companies of similar size and type, as well as a history of longstanding client relationships.

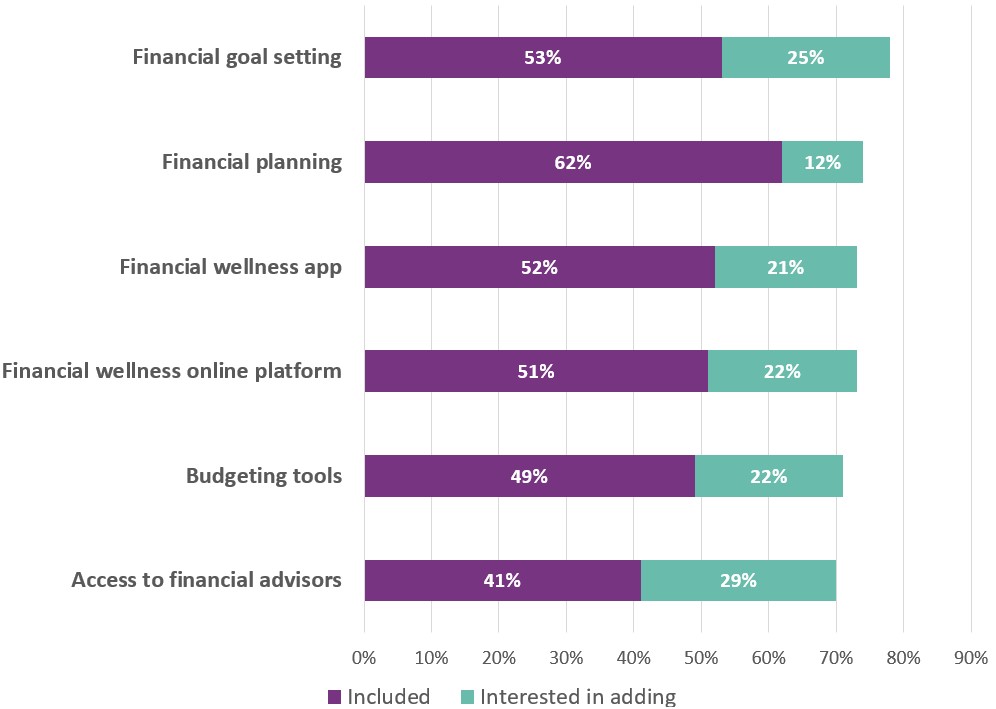

In a recent eMoney survey we asked employers who already offer financial wellness programs to their employees what they currently include and what they are interested in adding to their programs. Below are their top six combined responses:2

Similarly, we asked employers who are interested in offering financial wellness benefits but currently don’t, what features are important to include. The top three features are consistent with those who currently offer a financial wellness program, albeit in a slightly different order, with financial planning at the top followed by goal setting and an app.

Employers understand how the financial stress of their employees can impact the business. The success of financial wellness programs is often measured by the impact on employees and the organization itself. Among companies that offer a financial wellness program, 44 percent ranked the participation rate in the program and improved company culture as top benefits. These were followed closely by increased productivity (42 percent), increased employee retention (41 percent), and increased employee morale (40 percent).

For employers who are interested in offering a program, the level of importance of these measures ranked quite differently. Ranking highest for this group at 51 percent was increased employee morale. This was followed at some distance by increased productivity (42 percent) and with increased participation in retirement plan contributions, improved company culture, and increased employee retention all coming in at 40 percent. Interestingly, the participation rate in the program ranked eighth as a measure of success for this group.

Stress about finances has a greater impact on Gen Z and Millennials according to the Schwab Retirement Plan Services annual 401(k) Participant Study. Results show that 44 percent of Gen Z workers and 38 percent of Millennials reported that financial stress affected their ability to work over the past year, compared with 24 percent of all workers.3

Gen Z and their Millennial colleagues also have a higher degree of interest in financial benefits beyond the 401(k) than older generations. The survey showed these benefits include emergency savings accounts and tuition reimbursement.3 However, only 45 percent of workers say they receive wellness resources beyond retirement savings options.1

When combining the needs of younger generations with the desires of employers regarding financial wellness program deliverables, offering a digital financial wellness tool is a good solution.

According to SHRM, benefits experts say that there’s no comparison when it comes to training courses or human financial counselors versus technology platforms. The latter is better at giving employees 24/7 access to financial literacy, goal planning, and decision-support tools and can be scaled for more cost-effective delivery of financial wellness initiatives across large workforces.4

Additionally, there is a level of privacy inherent to digital applications that employees don’t get with other more public educational methods like workshops or presentations. The 2021 PwC Employee Financial Wellness Survey found that more than 50 percent of financially stressed employees were hesitant to ask their employers for help with their finances.5 The self-help aspect of a digital platform would also address the barrier younger workers expressed about not wanting to disclose their finances to their employer.

An ideal digital platform would provide workers with unbiased, relevant content, as well as access to financial professionals to answer more complex questions. When support is provided using the appeal of gamification, which speaks to the human desire for fun and engagement, it helps keep employees motivated to improve their financial health long term.

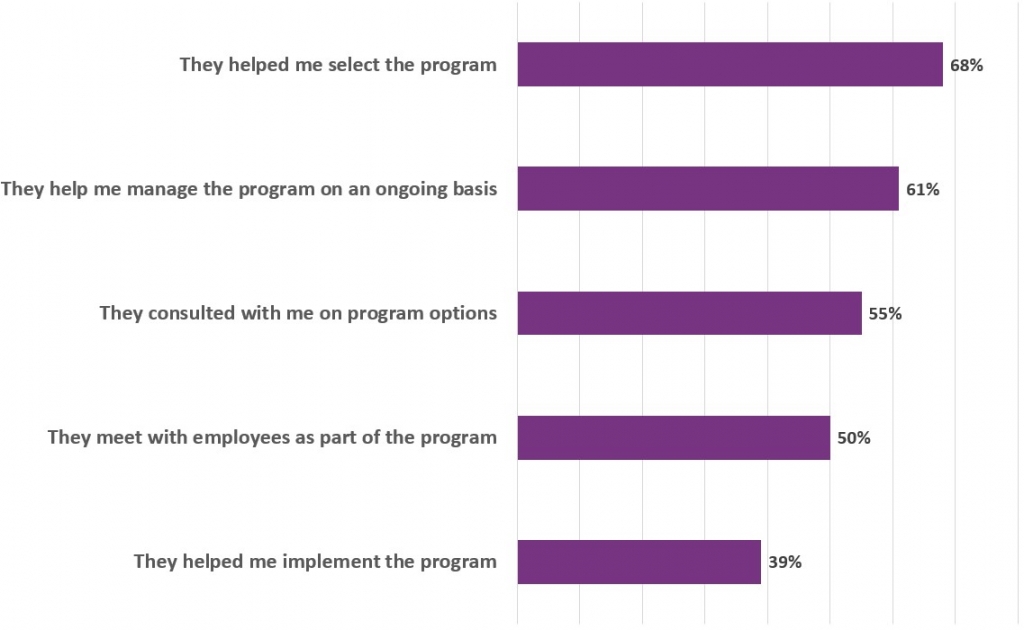

According to the employers polled for the eMoney survey, financial advisors are critical to the selection (68 percent) and ongoing management of financial wellness programs (61 percent). Only 3 percent of employers said their advisor is not involved in the program.

We also asked these employers what role they expect from their retirement advisor when it comes to their financial wellness program.

Financial advisor’s role in current financial wellness program

The companies that do not currently provide a financial wellness program, but are interested in doing so, expect a high overall level of involvement from the program providers, including customer support, marketing materials, and reports. When it comes to providing that customer support, 63 percent of these companies expect the provider to take the lead or do it all through multiple channels including email, phone, and chat.

So, while expectations are high, so is the opportunity. Only 33 percent of companies currently offer a financial wellness program and 85 percent of those who don’t say they would consider it in the future.

By acting as the retirement advisor who can provide a digital financial wellness solution, you have just differentiated your retirement benefits offering to rise above the rest while helping more people and growing your business.

DISCLAIMER: The eMoney Advisor Blog is meant as an educational and informative resource for financial professionals and individuals alike. It is not meant to be, and should not be taken as financial, legal, tax or other professional advice. Those seeking professional advice may do so by consulting with a professional advisor. eMoney Advisor will not be liable for any actions you may take based on the content of this blog.

* 2021 Fintech Breakthrough Award winner for “Best Wealth Management Product”

Sources:

1 “2022 Financial Wellness Survey Employers, Offering Holistic Financial Benefits Can Help Employees Improve and Maintain Financial Wellness.” TIAA-CREF Individual & Institutional Services, LLC, 2022. January 1. https://www.tiaa.org/public/pdf/2022_financial_wellness_survey_final_results.pdf.

2 eMoney, Plan Sponsor Financial Wellness, January 2022, n=509

3 “2021 401(k) Participant Study – Gen Z Focus.” Schwab Retirement Plan Services, Inc., 2021. September 1. https://content.schwab.com/web/retail/public/about-schwab/schwab_2021_401k_participant_survey_Gen_Z.pdf.

4 Zielinski, Dave. “Employers Turn to Financial Wellness for Workers.” SHRM, 2021. July 12. https://www.shrm.org/resourcesandtools/hr-topics/technology/pages/employers-turn-to-financial-wellness-for-workers.aspx.

5 PwC 10th Annual Employee Financial Wellness Survey.” PwC US, January 2021, n-1,600 Full-Time Employees https://www.pwc.com/us/en/services/consulting/workforce-of-the-future/library/employee-financial-wellness-survey.html.

You may also be interested in...

The world of financial planning is undergoing a series of profound transformations.1 Gone are the days when financial advisors were… Read More

In the competitive world of financial planning, staying ahead means leveraging technology to empower both you and your clients. Client… Read More

No two clients are alike, but they all share one thing: values that guide their decisions. Financial advisors who connect… Read More

Download our latest eBook for a complete guide to asking questions that spark productive conversations.

Download Nowa new source of expert insights for financial professionals.

Get StartedTips specific to the eMoney platform can be found in

the eMoney application, under Help, eMoney Advisor Blog.